This article is developed by Eastsprings Investments.

Source: https://www.eastspring.com/insights/outlook/2021-mid-year-outlook-navigating-an-uneven-recovery

Although investor optimism on the global economic recovery remains high, it is important not to underplay the economic risk from a resurgence in COVID-19 infections. Ooi Boon Peng, Head of Eastspring Investment Strategies and Kelvin Blacklock, Head of Eastspring Portfolio Advisers share their views on what is in store for the markets in the next 6 months.

Highlights include:

Global growth expected to rebound strongly as vaccines get rolled out across countries

The Financials, Industrials and Materials sectors are likely to benefit from the cyclical recovery

The US Federal Reserve to remain dovish till a sustainable rise in inflation becomes evident

Higher yielding bonds will continue to be sought after as rates remain low

Key risks include high government debt levels, policy mis-steps, unfavourable regulatory and tax changes

Boon Peng: The global economy looks set to enjoy strong growth in 2021, with the momentum going into 2022. Vaccinations are being administered across countries, albeit more effectively in the developed economies.

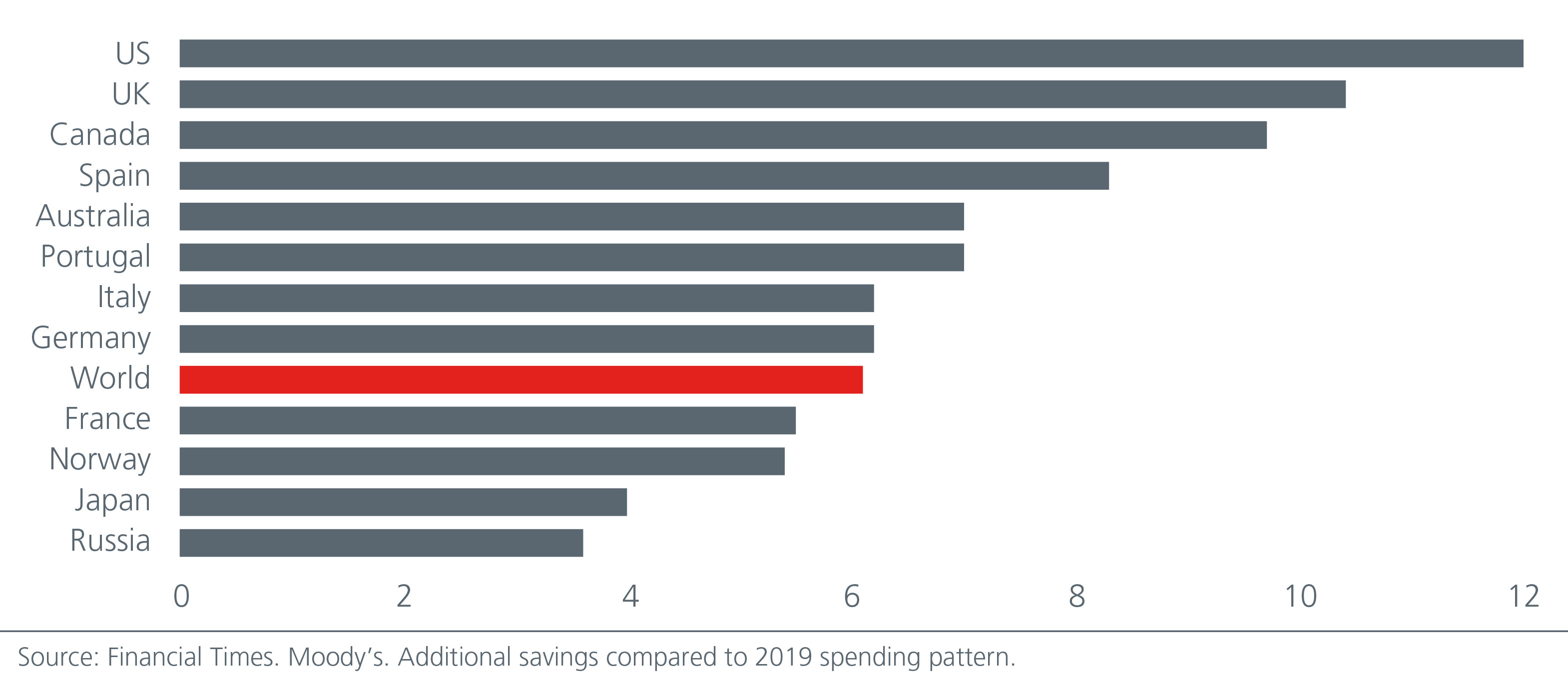

In the US, the pace of vaccination appears to be proceeding steadily. Coupled with the very substantial fiscal stimulus already in the economy, US GDP is likely to surpass 6%, above its 1.5-2.0% long-term GDP growth rate. The USD900 billion Consolidated Appropriation Act and the USD1.9 trillion American Rescue Plan Act 2021 would further boost household income significantly. Meanwhile, the improving jobs market means that the US consumers’ willingness to spend would potentially increase in the months ahead. Hence, we will probably experience a period of “US exceptionalism” with the country’s GDP growth very likely exceeding the rest of the world.

Asia, including China, in contrast has been conservative in their fiscal stimulus measures. To date, China has recovered well from the COVID-19 pandemic and the authorities are circumspect about pump-priming the economy, preferring to be prudent about leverage and return the country to a path of debt consolidation. At the point of writing1, the COVID-19 situation threatens to dampen growth in Asia where the emergence of COVID-19 variants and new infections dim hopes of economic re-opening. Although our global growth outlook remains positive, I do not underplay the economic risk from a resurgence in COVID-19 infections. Investors should monitor and assess the evolving situation closely given high investor optimism on global growth.

Fig. 1. Excess savings as % of GDP (estimated)

Source: Financial Times. Moody’s. Additional savings compared to 2019 spending pattern.

Boon Peng: Apart from the substantial fiscal stimulus boosting the US economy, US exceptionalism is also dependent on the US Federal Reserve (Fed) maintaining a loose monetary policy. The Fed currently has a benign view of long-term inflation and sees the need for policy patience until US growth is on a solid footing and inflation runs sustainably higher. With Asian governments clearly much more conservative in their fiscal stimulus measures, it is unlikely that Asian central banks will tighten policy ahead of the Fed. This means that Asian equity and credit markets should be underpinned by the prospect of low interest rates and supportive asset purchases.

The outlook for the USD is less clear, although the more obvious argument is that the USD should be supported by the US’ stronger growth prospects. However, optimism over the US economy is already largely factored into asset prices. The Fed would not be raising rates for a while. In addition, the significant fiscal stimulus has caused the US twin deficits to deteriorate. On balance, the USD is likely to stay range bound in the near term, but I expect select Asian currencies to resume their appreciation against the greenback in the medium term. In the next three to six months, we have a positive outlook on the Chinese yuan, Korean won and the Singapore dollar.

Kelvin: We remain positive on global equities. We prefer the US to broad Emerging Markets (EMs) as COVID-19 developments continue to play out and the likes of India and LATAM struggle to cope. There is also the increasing threat of higher interest rates that would disproportionately impact the more vulnerable EMs. We have also downgraded our view of US duration given high investor expectations for a strong economic recovery.

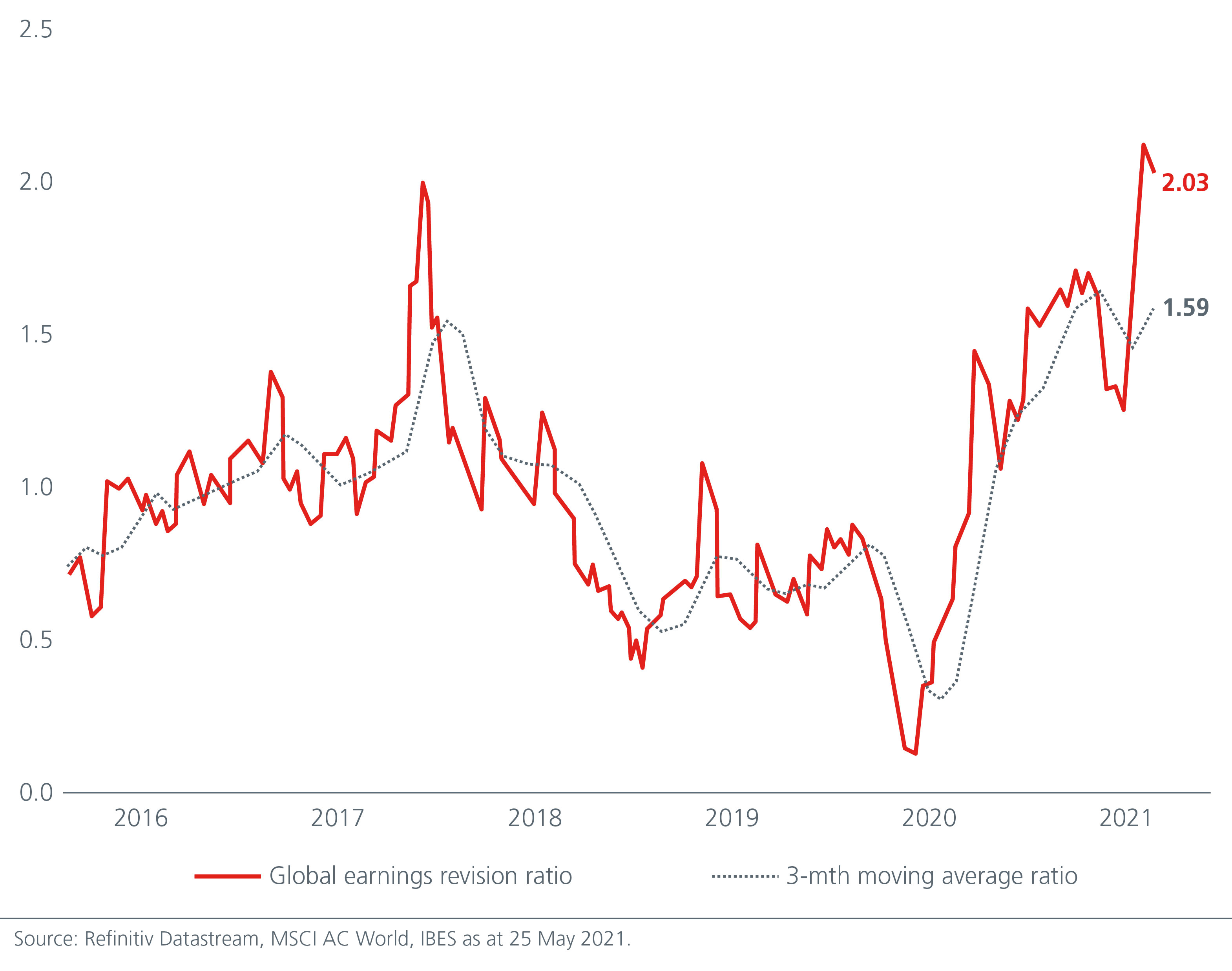

Accommodative monetary and fiscal policy remain in place and are crucial pillars of support to asset markets. Fiscal stimulus which includes direct cash injections to the consumer is elevating household disposable income and should boost consumer spending. This underlying demand is set to remain strong with companies reporting better-than-expected earnings.

This backdrop for risk assets leads us to favour high yields over investment grade debt but does not augur well for sovereign bonds. We feel that inflation is not an immediate cause of concern given that the recent rise has been driven by transient reopening factors and a rise in metal and oil prices, both of which may not indicate sustainable trends.

Nevertheless, it has the potential to become a structural problem later down the road, particularly if COVID-related supply bottlenecks sustain. Among equity sectors, we remain tilted to those that benefit from a cyclical recovery such as Financials, Industrials and Energy.

Fig. 2. Global earnings revision ratio (weekly)

Source: Refinitiv Datastream. Eastspring Investments.

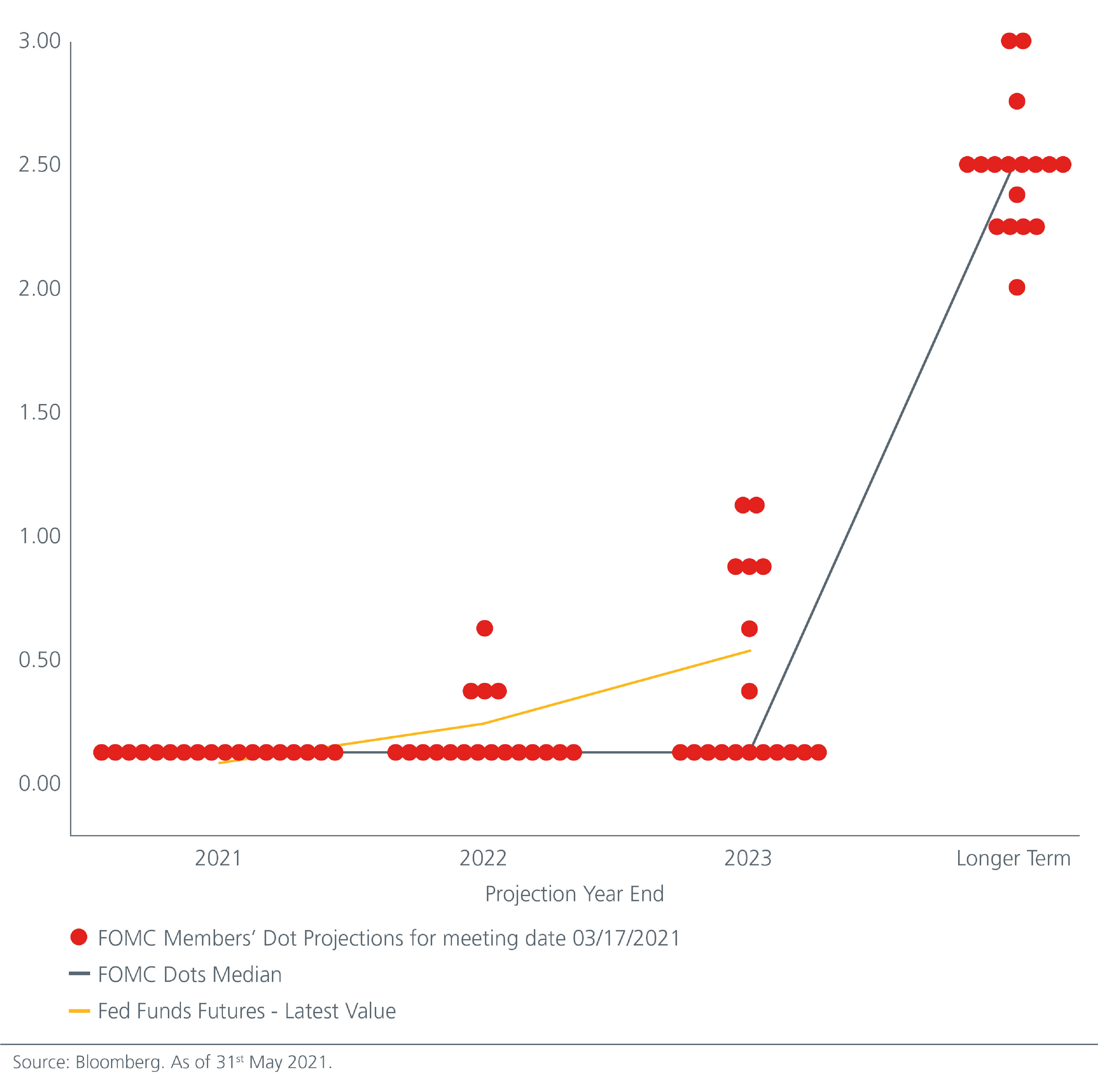

Boon Peng: At the point of writing2, the market has priced-in a 25-basis point (bp) rate hike by late 2022 and a further 25 bp by end 2023. This pricing is by no means very aggressive although it is more than the “do nothing” stance which the Fed has expressed through 2023. I believe that the Fed may tighten once in 2023. While the Fed has expressed increasing confidence over the economic outlook, it also wants to meet its full employment and inflation goals. Meanwhile, labour market slack in the US remains high. With the Fed’s average inflation targeting framework, 2020’s low inflation gives the Fed room to remain dovish. Recent US inflation data has moved up quite sharply partly due to base effects. The Fed will continue to monitor the price pressure developments going forward and will need more time to confirm that most of the increases in prices are indeed transitory.

Any unwinding of the market’s Fed rate hike expectations would likely come from disappointments over global growth, either from renewed economic risks posed by COVID-19 or from the inability of actual GDP numbers to meet elevated expectations. Meanwhile, the US 10-year Treasury yield has risen by over 100 bp since August 2020 to 1.65-1.70%3; at these levels, US Treasuries offer a reasonable safe-haven hedge for portfolios.

Kelvin: We are closely monitoring developments around the Fed’s reaction function to increasing signs of inflation. The Fed has been explicit that they will allow the US economy to “run hot” and permit an inflation overshoot above their 2% target in line with their average inflation targeting policy. Nonetheless interest rate futures markets have begun to bet on a rate hike as soon as 2022.

As stated earlier, inflation is not an immediate cause of concern. We think the Fed will need more evidence of permanence in the rise of inflation, and a closing of the output gap before it signals that a lift-off is necessary. Even so, if the Fed is intent on changing their interest rate policy, this will be clearly messaged well ahead of the event and the quantum of hikes are likely to be muted. The risks of increasing the cost of financing before the economy has truly “escaped” from the effects of the pandemic make this a high hurdle to surpass. Nonetheless we are wary about longer term structural inflation at some point derailing markets but that seems someway off for now.

Investors may feel increasingly concerned about the threat of inflation and see the need to react immediately. But we urge caution given the distorting base effects versus first quarter of 2020, and to await clearer data signals from consumer demand and the Fed’s reaction function

Fig. 3. Implied Fed Funds Target Rate

Boon Peng: The rise in debt globally in recent years has been government-led, largely arising from the fiscal measures needed to mitigate the economic contraction caused by the COVID-19 pandemic. The build-up in sovereign debt could impact the credit ratings in some EMs, e.g. India. Investors will have to be selective within the EMs and having the flexibility to dynamically allocate across different sectors can help investors enjoy the region’s higher yields, but with lower volatility.

Elevated government debt levels would pose a risk to growth and consequently increase defaults if inflation becomes an issue. In the face of high and sustainable inflation, significant central bank tightening would impede growth and make it challenging to service debt. However, until this comes about, the twin impact from low rates and asset purchases by the Fed and European Central Bank should be supportive of credit markets.

Within the corporate sector, we do not expect defaults to rise substantially in the near term as the economic upswing lifts corporate earnings. This should in turn help contain credit spreads although active credit analysis and being selective remains key. While we expect the default rates in the Asian High Yield bond market to remain flat or rise moderately, we expect defaults to remain manageable. The Asian High Yield market’s attractive valuations, higher yields and shorter duration make it a compelling proposition for yield seeking investors although investors may need to ride through the current period of volatility.

Onshore bond defaults are likely to pick up in China as the government seeks to reduce net leverage in the system and reduce moral hazard in its bond market. That said, government support of state-controlled entities is likely to be assessed on a case by case basis, with the aim to avoid any financial systemic risks.

Kelvin: With ever more stimulus being discussed, and given resurgent consumer demand and robust corporate earnings, our base case remains positive for risk assets. That said, we are mindful that a number of risk factors could materialise to impede the current recovery.

Higher debt costs at the national level as opposed to the corporate level can become an issue going forward if inflation picks up. At the same time, a policy mis-step from central banks or governments that prematurely reverses the current supportive monetary and fiscal policy will be damaging; any tapering or reversal of stimulus must be well telegraphed and sufficiently justified.

On the corporate front, any unfavourable regulatory and tax changes in the US possibly targeting big tech and banks as per the Democrats pre-election campaign messaging needs to be monitored. Further, we think that corporates that fail to adapt their business models to the prevailing environment will be impacted. Those corporates who were dynamic and proactive in their responses to the pandemic have reaped the rewards.

Going forward, we see ESG concerns and sustainable corporate behaviour of paramount importance. Companies that fail to align with this change will suffer from reputational damage, weaker share prices and higher costs of financing.

Kelvin: Undoubtedly one of the major themes that has garnered investor interest and increased engagement with the asset management community is the integration of ESG policies and principles. Our team implements mandates for the asset owner and therefore takes the policy direction from our clients.

Our parent, Prudential Plc recently adopted a new Group ESG Strategy and a key point to note is its new goal of becoming “net zero” by 2050. In line with this, we have partnered with our parent to initiate the development of an investment programme that aims to reduce the carbon intensity of portfolios over time, where Prudential has direct control over the investment mandate. This programme focuses on both managing the potential impacts to climate risks in existing mandates and promoting the investment opportunities that are presented.

Stewardship and engagement play a central role in encouraging a transition process toward renewable energy. The Group ESG Strategy also supports a just transition for EMs. Prudential intends to join the United Nations-convened Net Zero Asset Owner Alliance, a network of institutional investors committed to the decarbonisation of their portfolios. Eastspring is also committed to developing a comprehensive and distinctive range of Asia-focused ESG investment strategies.

113 May 2021

213 May 2021

3As at 14 May 2021.

The information in this article does not necessarily reflect the views of Prudential Assurance Company Singapore (Pte) Ltd (“PACS”). PACS does not represent that such information is accurate or complete and should not be relied upon as such. This article is for your information only and does not consider your specific investment objectives, financial situation or needs. We recommend that you seek advice from a PACS Financial Consultant before making a commitment to purchase a policy.

Information is correct as at 15/07/2021.

Tags: Retirement, Health, Wealth

This article is developed by Eastsprings Investments. To learn more about Eastspring Investments, click here.

Financial health and wellness insights