Global healthcare systems have been under intense pressure in the fight against Covid-19. The pandemic has exposed gaps in preparedness and health capacity which will trigger increased spending on healthcare infrastructure and research capabilities. Equally, it revealed interesting investment possibilities as technology spawns new age healthtech entities.

Asia, the epicentre of this virus, has handled the outbreak with varying degrees of success. For some Asian countries, the experience, lessons learnt, and healthcare investments made post the 2003 SARS outbreak were good starting points. For others, the struggle to contain the virus highlighted years of inadequate healthcare spending.

The Covid-19 pandemic has also brought to light many issues ranging from the importance of having a sufficient stockpile of vital protective medical equipment and vaccine research & development to the ease and efficacy with which technology was employed to help combat the spread of the virus. These learnings will likely have implications for supply chain reliability, research spending and the pace of healthcare digitalisation.

The economic costs of this pandemic have been huge. This realisation should in itself warrant significantly higher healthcare spending by countries to be better equipped to face the next crisis. In truth, healthcare demand has been on the rise, precipitated by expanding and aging populations, growing chronic diseases, increasing health consciousness and rising affluence.

These triggers are particularly evident in Asia which is home to 60% of the world’s population. By 2030, the region will also be home to 60% of the world’s population aged 65 years or older. The total healthcare spend in Asia is estimated to exceed USD 4 trillion by 20241, with hospitals, home care, telemedicine, medical devices and drug research expected to lead the way.

The key sectors of a healthcare industry can be broadly classified into the following four sub-segments: Healthcare services and facilities (hospitals, community hospitals, managed care), drug manufacturers (pharmaceutical & biotechs), manufacturers of medical devices, equipment, and hospital supplies, and distributors of medical related products. Asia, a major global player in some of the areas, is expected to further benefit from the current health crisis.

According to Eastspring’s Shanghai-based research team, China is a key contributor to the recovery of the global healthcare supply chain. The robustness of China’s production capacity is recognised not only in manufacturing but also in service sectors like contract research service.

China is a major player in low-end active pharmaceutical ingredients (APIs), while high-end APIs are mainly produced in Europe, the US and India. Nevertheless, the trend over the past decade to move production of high-end APIs to China has escalated after the Covid-19 outbreak. There are more high-end API orders, which further assists manufacturing upgrade. Meanwhile China’s medical research and development in vaccine and innovative drugs have gained unprecedented traction during the coronavirus outbreak. China is currently in a leading position in the Covid-19 vaccine clinical trial rally. Moreover, as the result of more stringent post-epidemic fee-control, we expect to see structural advancements in the industry and more frequent replacement cycles in drugs. The team believes that the innovation in the pharmaceutical industry will accelerate which underpins their conviction in this sector.

Meanwhile, Malaysia is one of the largest medical gloves (both nitrile and latex versions) manufacturer in the world, commanding a global share of 65% says Lilian See, Eastspring Malaysia’s Head of Research. Post Covid-19, other countries may expedite their capacity expansion in order to be self-sufficient. Nonetheless Malaysian glove producers are leading in terms of technology with more efficient production lines, plus glove demand tends to be inelastic. The country also has an edge in medical devices. Strong ecosystems in the semi-conductor, metal stamping and plastics industries makes it an ideal procurement centre for parts and components used to manufacture medical devices such as catheters, syringes, needles, and X-ray apparatus.

Other countries have also shown their manufacturing prowess. Nelson Yeh from Eastspring Taiwan’s Equity & Research team says the country’s face mask manufacturers quickly ramped up production to meet the sudden increase in demand. The ability to do so bodes well as global brands seek to diversify their production sites and decrease reliance on a single source. The country’s API manufacturers may also benefit from this diversification trend.

According to Eastspring Indonesia, the country has under-invested in terms of bed capacity and medical workers and as such hospital infrastructure will continue to be a major growth driver in the future. Further, some listed local enterprises are planning to boost API production capacity so that Indonesia's API imports can be reduced to 65% by 2023 from 90% currently.

Likewise, the rush to produce vaccines and drugs to treat Covid-19 will benefit the pharmaceutical industry as will greater investment in pandemic prevention. Generic drug makers too stand to gain; some Indian pharmaceutical companies are benefitting from the global efforts to treat Covid-19 patients. For example, the US Food & Drug Administration expedited the approval process of a generic version of an inhaler drug for asthma to meet the challenges of Covid-192.

It is also important to note the investment opportunities are not only limited to healthcare segments. For example, rubber manufacturers will benefit from higher gloves demand. There will be more demand for steel, one of the raw materials widely used to manufacture various medical components such as medical stampings, wire products, and medical blades. Similarly, plastics are the major raw materials for various medical supplies and component materials used in medical devices.

One other area that will likely see a surge in investments is digital healthcare, seeing how technology has been successfully used in the fight against Covid-19. Ultimately, integrating information and communication technology in healthcare can lead to more efficient healthcare systems and lower healthcare costs.

A report by International Data Corporation shows that Asia Pacific’s healthcare information technology (IT) sector spending is forecast to increase from USD 12.2 billion in 2019 to USD 14.9 billion by 2022, at a compounded average growth rate of 7%, led by software and IT services3. China spends the most followed by Singapore and Australia.

Technology’s merit is evident industry-wide. Hospitals, for example, utilise drones to fetch medications so that nurses can spend more time for patient-care. Digitising medical records also lessens the administrative burden and increases overall productivity.

Another area that is gaining traction is that of medical wearables. As lifestyle-associated diseases (such as diabetes) rise, it creates a need to monitor health on a regular basis. Clinical data tracked by these devices allows healthcare providers to stay connected to patients and take timely action. Asia Pacific’s wearable medical device market is forecast to experience the highest growth of any region between 2020 -20304.

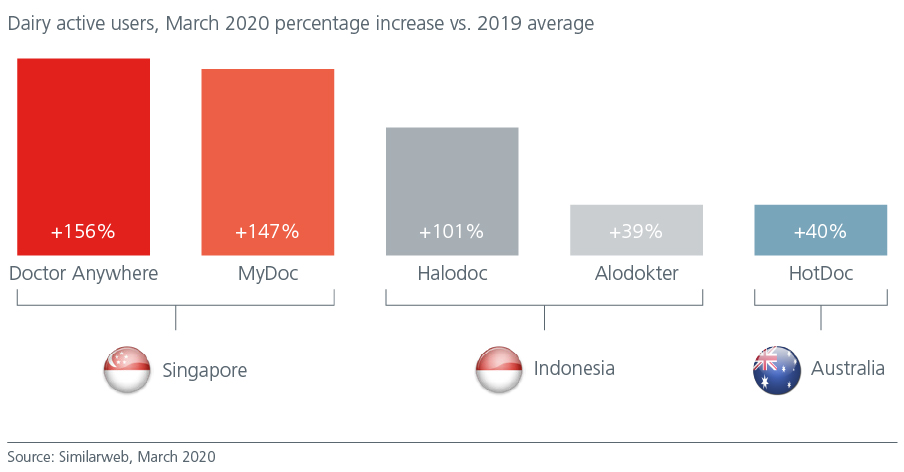

Online medical platforms have also seen accelerated growth since Covid-19. See Fig 1. Telemedicine’s rising popularity is due to a number of factors. First, it allows doctors to treat patients from a distance i.e. even remote areas can get medical attention. Second, it is convenient for patients especially during the Covid-19 lockdowns. Third, it optimises resources and reduces strain on healthcare systems during a demand surge.

Fig 1: Telemedicine gains popularity in Asia Pacific

With 5G networks being rolled out, support for digitised healthcare will likely increase in the coming years. Future healthcare will not just focus on convenience and affordability but also on predictive and preventive care models. Already, India, China and Singapore are emerging as key healthtech hubs5.

In a study published in the scientific journal Foods, researchers confirmed that turmeric has a multitude of health benefits, with significant antioxidant and anti-inflammatory effects — oxidative damage is believed to be the cause of many diseases, while inflammation has been linked to the development of chronic illnesses such as cancer and Alzheimer’s disease. According to the same study, even a relatively low dose provides health benefits — but the catch is that turmeric isn’t as effective when eaten on its own. The trick is to eat it with black pepper, which researchers say increases its absorption by 2000%. Curry night it is.

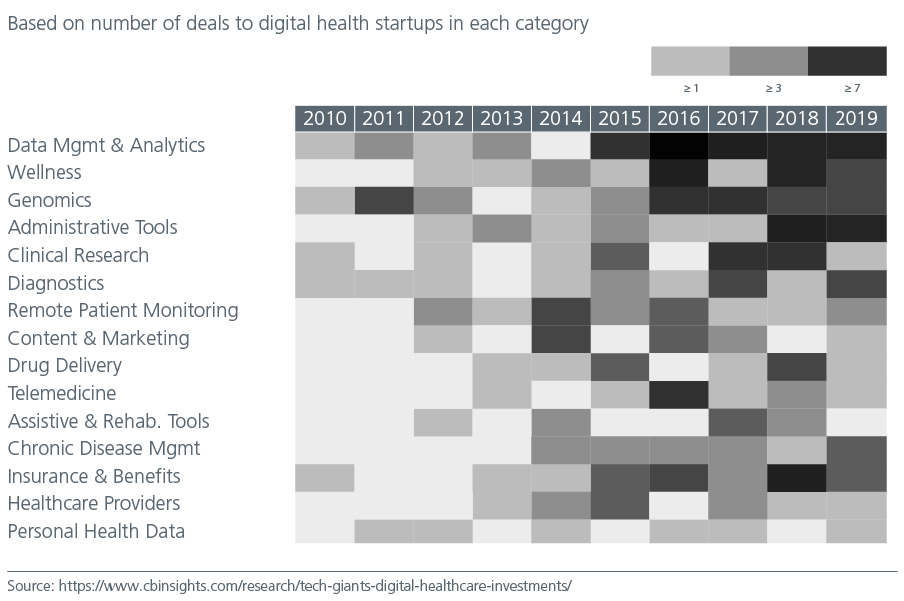

Given the size and growth of Asia’s healthcare market and the power of technology to transform the industry, more technology giants will likely want to enter into partnerships and/or take stakes in healthcare companies. See Fig 2. Apple, Amazon and Google have all begun moving into the healthcare space. Companies that can package end-to-end medical solutions that cater to each customer’s entire needs, will likely capture more market share.

Fig 2 : Big Techs up their stakes in healthcare

But advances in telehealth will have to be matched by strong, consistent and proactive regulatory measures to safeguard patients’ interests. The credibility and power of the new partnerships will strongly depend on their ability to protect the data that they hold. There will also be increasing demand for solutions to manage cyber threats in healthcare.

Medical liability is another area that remains grey. Despite having the resources and technical knowledge to create healthcare tools, will big tech companies be willing to accept the medical liabilities that may arise if their predictive devices malfunctioned and provided the wrong advice? A clear framework that addresses these issues has to be in place.

Integrating technology into healthcare will undoubtedly improve the latter’s overall quality. But given the very different country profiles in Asia Pacific, successful healthtech companies will be those that can offer differentiated technology and one-stop customised solutions that appeal to customers across markets.

This article is contributed by Eastspring Investments and is one of six articles in their Asian Expert Series. To learn more about Eastspring Investments, click here1Quadria Capital : Shaping Asia’s healthcare for tomorrow, Sep 2018

3Healthcare IT spending forecast and trends by IDC – May 2019

5Asia HealthTech Investment Landscape 2018 Report, Galen Growth Asia, January 2019

Tags: Retirement, Health, Wealth

Financial health and wellness insights