Singaporeans are living longer. What does that mean for your future plans, finances and health?

Singaporeans are justifiably proud that they live in a country that innovates and prepares for the future. Thanks to advances in medical technology, more Singaporeans can expect to live to the age of 1001. And with that extension, the way we work, play and think about our health will all have to adapt.

1. An Opportunity to Replay Your Younger Years

In the past, most people studied

in school and university, delved straight into work or national service after graduation, and never

looked back.

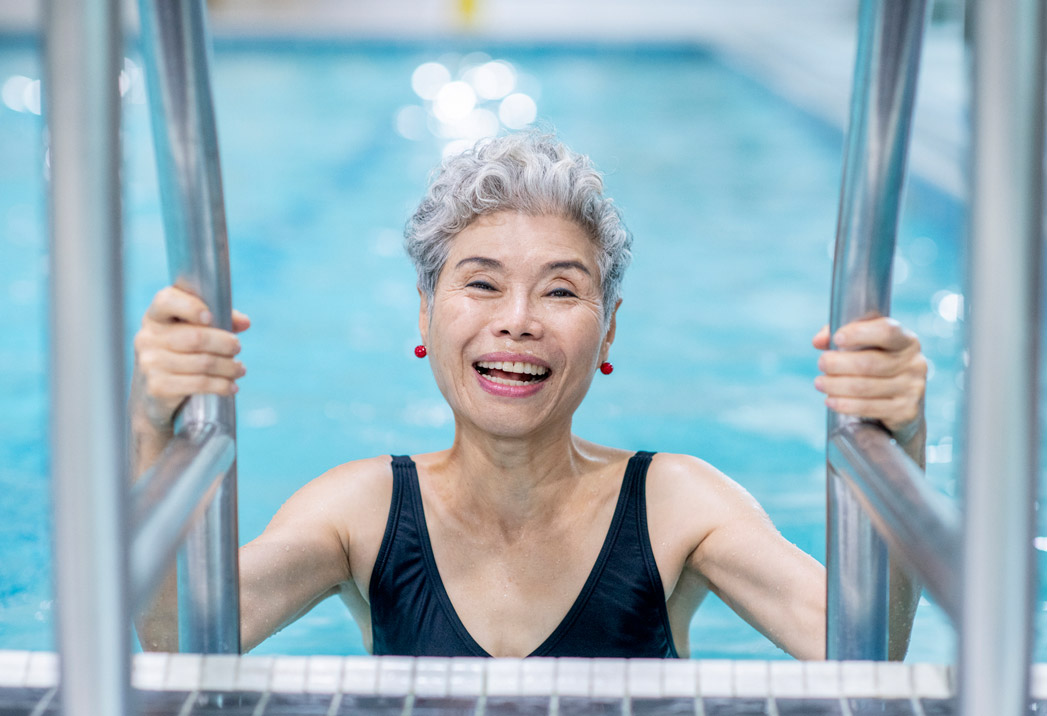

Now, a longer lifespan gives you more time to take breaks and enjoy all the adventures you couldn’t the first time around, well past retirement age. Imagine yourself skydiving at a ripe old age like Irene O’Shea, who jumped out of a plane aged 102.

Or if you want, the prospect of a gap year in your golden years is now a clear possibility — and an exciting one, at that! But first, you have to make sure you are financially and physically fit.

2. A Fresh, Fun Way to Invest

A longer lifespan means you can look in the longer

term. You can invest in areas that take longer to mature, but that may worry you less because you

know you can nurture this passion project for decades. Just like a skydiver, you can jump into new

territories. You might become a supportive investor who helps a young family friend get their music

app business off the ground. Or bring your passion for nature to life by joining a fund which only

invests in eco-friendly projects. Maybe even start an investment group with your friends, and grow

your relationships as you grow your wealth?

At the same time, you can ensure stable financial returns over the longer term, by sourcing an insurance plan that keeps pace with your changing needs

3. More Time…for Everything

A few short decades ago, people expected to have one career throughout their life — with no room to

have a job they were truly passionate about. When being a century old is normal, opportunities open

up. Now, you might retire from one job in your 60s, then start a new career in an entirely new space

you’ve always loved — from banking to baking, perhaps.

The important thing is to ensure that you can handle any exciting lifestyle change with health, and not just by relying on a robust medical insurance plan. Living to 100 means eating well and regular exercise are more key than ever. Currently, only a quarter of Singaporeans say they are ready from a health perspective to live to 100 years1. But with renewed dedication to healthy habits, from cutting sugary drinks to exercising daily, that number can shift.

A longer lifespan also means more time to save — and you will need it. If you want to live the skydiving life, one full of adventure across many decades, you’ll need the money to support it. The earlier you start to set savings targets, and understand the mechanics of different financial tools, the earlier you can build a strong nest egg.

So: you’ve got glorious time on your hands. The only question now is, what do you want to do to make the most of it.

If you’re keen to learn more about what living to 100 means for you, you can read our full research report.

1Ready for 100 Whitepaper, 2018, a study conducted by EIU commissioned by Prudential Singapore.

Tags: Retirement, Health, Wealth

Financial health and wellness insights