The VUCA World Model: Essential Skills for the Next Generation of Wealth Stewards

The competencies required for the next generation to effectively manage and grow their wealth will be vastly different from those of their predecessors. It’s time to consider the skills that will shape your children or heirs into effective custodians of your legacy.

Your children or grandchildren are the torchbearers of the wealth and reputation you’ve painstakingly built over your lifetime. While they may not yet be ready to step into your shoes, it’s crucial to equip them with the future-focused skills they’ll need to navigate the increasingly complex landscape of business and wealth management. Digital literacy, critical thinking, and creativity are common skills quoted as important future ready skills.

Consider also the importance of attributes that will be indispensable for the next generation of leaders: emotional intelligence, strategic and innovative thinking, and self-awareness. A recent survey revealed that effective communication (45.2%), interpersonal skills (44.2%), and ethics (41.9%) are the top three qualities people seek in a leader.

But how do you cultivate leadership robust enough to navigate the VUCA world?

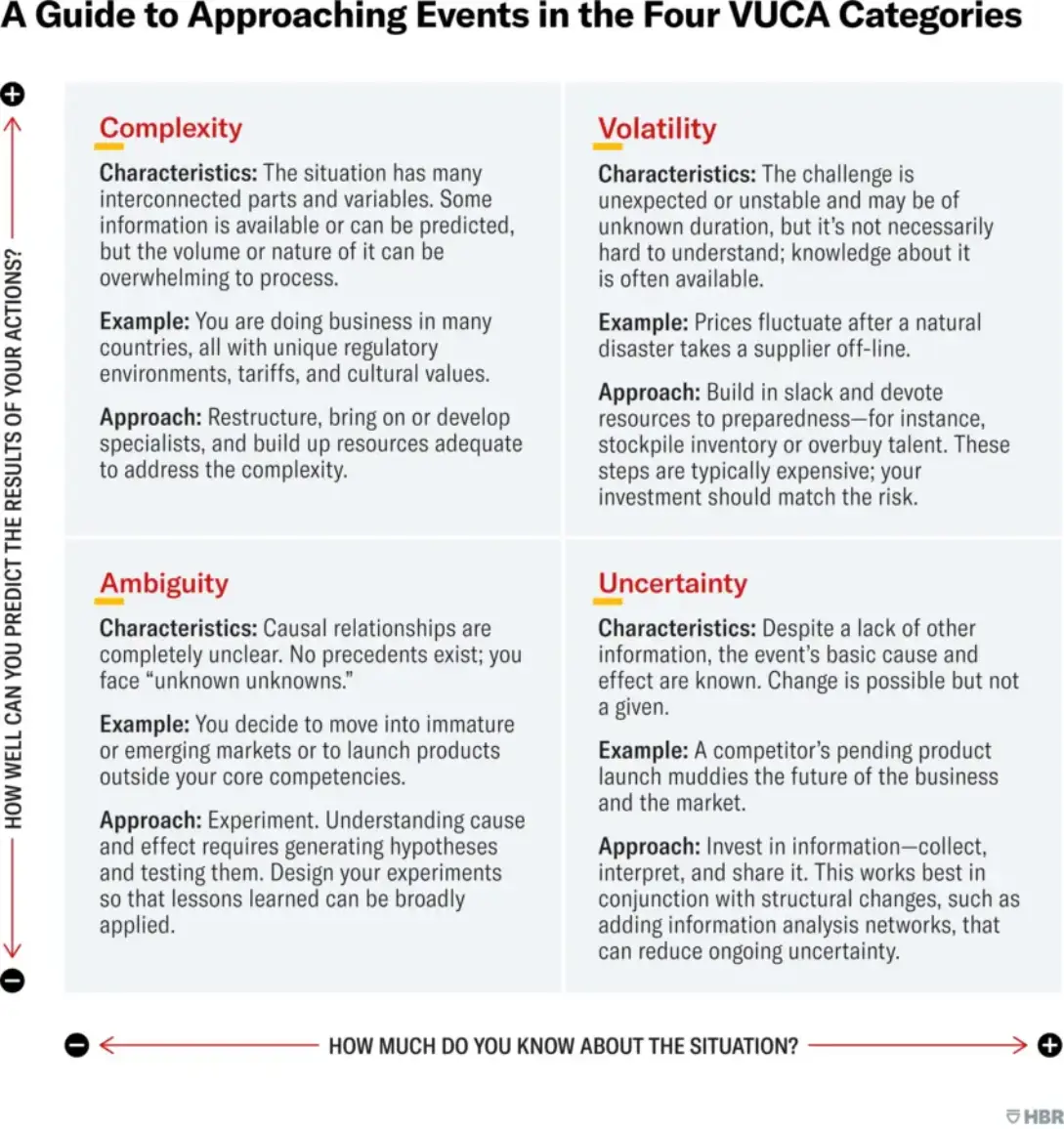

VUCA, an acronym for Volatility, Uncertainty, Complexity, and Ambiguity, describes the new reality of our world. This model suggests that future leaders and entrepreneurs will need to apply a more rigorous thought process when crafting business strategies for their organizations.

Source: Harvard Business Review

In today’s digital age, a plethora of enrichment activities, courses, both locally developed and international are easily available to our children to learn and to develop these skills. With content available everywhere and in all forms, it’s useful to consider the skills, knowledge, and network you’d like your children to focus on or access to which may provide more relevance to the line of business you are in.

The Imperative of Early Financial Literacy

Financial literacy is seen as a crucial skill for the wealthy to safeguard their wealth and make informed investments and business choices. Programs for children as young as three years old are available, including these free online resources by Eastspring Investments. These resources can introduce your children to foundational knowledge on money and wealth.

Digital Renaissance

As digital transformation continues to reshape industries and our world, investing time to learn, understand business applications and related risk management skills can provide your children and heirs the necessary foundation needed to lead your enterprise into the digital era and beyond.

Trends like artificial intelligence, data science, blockchain, robotic process automation are skills will have major implications for businesses currently and in the future. Another area of increasing focus is on sustainability and how businesses are expected to play bigger roles in adopting eco-conscious practices, promoting responsible consumption, and driving positive impact on the society and environment.

Cultivating Creative Leadership

Cultivating creative leadership in the next generation requires fostering an environment that encourages innovation, risk-taking, and diverse thinking.

Start by promoting a culture of curiosity and continuous learning, where questions and new ideas are welcomed. Prioritize diversity and inclusion to ensure a wide range of perspectives and ideas. Provide opportunities for cross-disciplinary collaboration, which can spark innovative solutions.

Many top performing organisations around the world also Incorporate design thinking into problem-solving processes to stimulate creativity. Encourage your children and heirs to experiment widely and to embrace failure as a learning opportunity, rather than a setback.

Remember, creative leadership isn’t about having all the answers, but about asking the right questions and inspiring others to do the same.

Balancing the Present and the Future

While it’s important to prepare for the future, it’s equally crucial to focus on your children’s present needs. In the pursuit of technical and professional skills, personal development and well-being are equally important to create resilient and socially responsible adults.

Allocating time for play, relaxation, and family bonding and modelling the kind of work-life integration you’d want them to emulate serves as a guide for them as they navigate adulthood and professional life.

Lastly, and perhaps most importantly, invest in mentorship and coaching to guide these young leaders in their development. The wisdom from your years of experience and how you navigated the changing business environment are invaluable lessons. Our past informs the future and knowing the history of your legacy empowers the new generation of leaders to make wiser decisions.

When it comes to wealth management, you and your family can rely on Opus by Prudential and our experienced team of Private Wealth Consultants to provide you with professional guidance and advice. Make time to craft your legacy today.

The information in this article does not necessarily reflect the views of Prudential. Prudential does not represent that such information is accurate or complete and should not be relied upon as such.

This article is for your information only and does not consider your specific investment objectives, financial situation or needs. We recommend that you seek advice from a Prudential Financial Consultant before making a commitment to purchase a policy.

Information is correct as at 14/07/2023.