Quick country overview

Prudential Assurance Company Singapore (PACS) is one of Singapore’s leading life insurance companies. We are one of the market leaders in protection, savings and investment-linked plans, with S$49.3 billion funds under management as at 31 December 2020.

We have been serving the financial needs of Singapore for 90 years, delivering a suite of product offerings and professional advisory for approximately 1 million customers through our network of more than 5,000 financial consultants and our bank partners, supported by our 1,200 employees.

We have one of the largest agency forces in Singapore and hold a top-3 position in the bancassurance channel via our strategic partnerships with United Overseas Bank and Standard Chartered Bank. Our 2,300 corporate and small and medium sized enterprise clients benefit from our specialised enterprise business solutions. We also offer a dedicated advice and service-led offering, Opus by Prudential, to our High Net Worth customers.

For every life, for every future. Today, we help Singaporeans by making healthcare accessible and affordable, growing the wealth of our customers and empowering them to save for their goals.

Looking back: A Timeline

1931

Prudential opens its first full branch in Singapore at Raffles Square on 1 March, writing 540 policies with £194,200 sums assured.

1941-1945

Even during the Second World War and the occupation by Japan, we keep our customers’ records safe and stayed in touch with policyholders as much as possible.

1945

We re-open after the war and reinstate pre-war insurance policies, even though premiums were not paid during the war. The future of our business and that of our customers are always top of mind, and we help customers to renew their insurance policies and receive full benefits.

1948

We are recognised for being the highest achiever in the Prudential group with 3,355 policies in force in 1948, a big number for that time.

1949

PACS is given complete authority on underwriting.

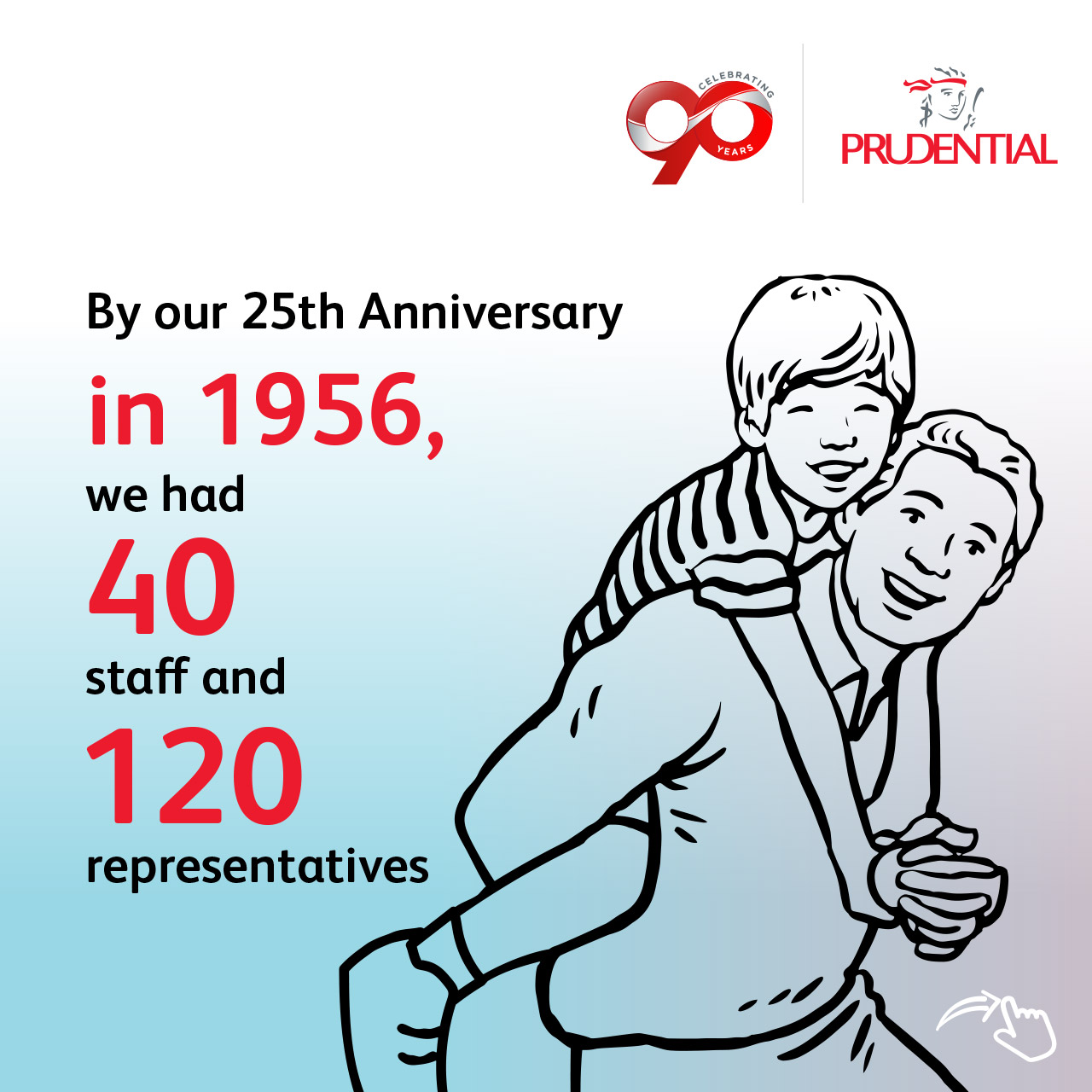

1956

Our 25th anniversary – we now have 40 staff (up from three in 1931) and 120 representatives (up from one in 1931).

1965

Singapore gains independence and the branch name is changed to South East Asia.

1974

We are one of the chief partners in financing the construction of Ocean Building, a 27-storey office tower which will become our head office for over 20 years.

1990

We are third in the Singapore market with £34.7 million of business, with 70,000 policyholders and 1,000 agents.

1991

The Singapore transfers to a new subsidiary company and is now named Prudential Assurance Company Singapore. We launch our first television advertisement with the tagline ‘When you’ve been around as long as we have, you know what life is about’.

1994

PACS becomes part of Prudential Corporation Asia, which was established to oversee strategy and expansion in the Asia region.

1995

The regional advertising campaign and tagline ‘Always Listening, Always Understanding’ is launched.

We win the National Productivity Award, awarded by the National Productivity Board.

1998

We launch a bancassurance partnership with Standard Chartered Bank.

1999

We move into Prudential Tower, a 30-storey head office in Singapore’s Central Business District.

2000

PACS is named life insurance company of the year at the Asia Insurance Industry Awards. We also launch a new PruCard, the first credit card that allowed customers to earn reward points to pay their premiums.

2004

We achieve a milestone of one million policies.

2012

PACS celebrates our 20th anniversary since being the first to launch a complete suite of Investment-Linked Life Insurance Policies in Singapore. We introduce PRUInvest, a first-to-market portal to enhance the customer experience for our Single Premium Investment-Linked Life Insurance Policies customers.

2013

We are awarded the prestigious Asia’s Best Employer Award.

2014

We become the first insurer to be conferred the Plaque of Commendation (Gold) Award by the National Trades Union Congress.

2017

We move into our Marina One office, PRU WorkPLAYce, that is designed to inspire innovation and blending creativity, collaboration and wellness.

We are the first in Singapore to adopt a claims-based pricing for our PRUShield Plans and remain established as one of the leaders in Shield.

We launch the PRU Fintegrate Partnership, where we partner fintech startups in Singapore and globally to develop digital solutions for customers.

We also launch askPRU, the first AI-powered chatbot in the industry to provide our financial consultants with real-time information about their customers’ policies.

PACS inks a five-year Grand Sponsorship commitment (2018-2022) to the Singapore FinTech Festival, the largest of its kind in the world.

2018

We are the first financial institution in Singapore to enable employees to work beyond the statutory retirement age of 62.

2019

We equalise the Central Provident Fund contribution rate for employees above age 55 and introduce first-in-market medical plans to cover the employees of corporate clients up to age 100.

2020

PACS launches Pulse by Prudential (“Pulse”), an AI-powered mobile app to provide Singapore residents with round-the-clock access to healthcare services and real-time health information.

Singapore enters a Circuit Breaker period due to the COVID-19 pandemic. We swiftly roll out PRURemote Advice within seven days, a video conferencing and e-signature tool that allows our financial consultants to remain engaged with their customers for advisory and policy sales virtually.

We set up a PRUCare Package to support the community, consisting of S$3.5 million in cash benefits and donations to aid more than 3,400 individuals. Together with the rest of Singapore’s insurance industry, we defer premium payments and provide hospitalisation benefits for COVID-19 patients to reduce the financial burden on our customers.

PACS is awarded the highest score in the Insurance category in a 2020 national customer survey, the Customer Satisfaction Index of Singapore.

PACS is named one of LinkedIn’s Top 15 Companies in Singapore, and the only insurer in the list.

2021

PACS launches Wealth@Pulse on Pulse, to help Singaporeans better plan for rising longevity with new wealth solutions.

We introduce PRUSafe Covid Cover on Pulse, a complimentary microinsurance plan that offers complimentary financial protection against the side effects of COVID-19 vaccinations.

Our 5,000-strong agency undergoes a certification programme, Certificate in Financial Needs Analysis and Plan Construction (Level 1), which is accredited by the Institute of Banking and Finance (IBF). We will have the highest number of IBF-certified financial consultants in the life insurance industry by end 2021.

More than 120 employees have undergone the Professional Conversion Programme to date, supported by PACS and IBF, to enhance their skillsets for future-readiness and strengthen our workforce capabilities.

We believe in cultivating a Do Good culture and promoting sustainable volunteerism to help people get the most out of life. The Prudential Longevity Pledge was also set up this year to support the vulnerable groups in our community.

Looking forward

PACS is transitioning to become a more innovative and agile organisation that can adapt quickly to the rapidly changing needs of our customers. Having become a company of choice for both customers and employees and steadily improving our market positioning, these showcase the results of our transformation.

For every life, for every future. PACS will continue to leverage digital technology in health, wealth, work or relationships, and to look for new ways to help everyone live well for longer.

++++

Did you know?

- Encouraging collaboration and inclusivity, an agile and innovative organisation – Inspired by Albert Einstein’s philosophy that play is the highest form of research, PACS’ WorkPLAYce integrates work and play at the office with areas for focused work, collaboration and innovation, and socialisation. It runs on an activity-based work model, where employees can choose the workspace best suited to their working style and task at hand, and the flexibility and autonomy to work from anywhere, anytime. This creative and collaborative way of working means that there are no designated offices for senior staff in our buildings!

- Bring on 100 – PACS has a Ready for 100 research programme that examines the opportunities and challenges for Singapore residents as people live longer. It evaluates the readiness of Singapore residents for longevity across various pillars such as relationships, health and wellness, financial lifestyles and attitudes at work. Each year, we engage the community on ways to prepare for longevity and #BringOn100.