See all your financial information at one glance

SGFinDex lets you instantly retrieve all your financial information faster and safer via Singpass authentication. Get an overview of your financial portfolio such as savings, insurance and investment all in one place. This way, you can have a sense of how to plan your future confidently.

What data you can

retrieve in a

consolidated view

-

Insurance

-

Banks

-

Government entities (HDB, IRAS and CPF)

-

SGX CDP

Why use SGFinDex

How to use SGFinDex

Connect SGFinDex

Have the following beforehand

Your PRUAccess login credentials

Your Singpass QR login

Your account login credentials from the financial institutions you wish to connect

Connect

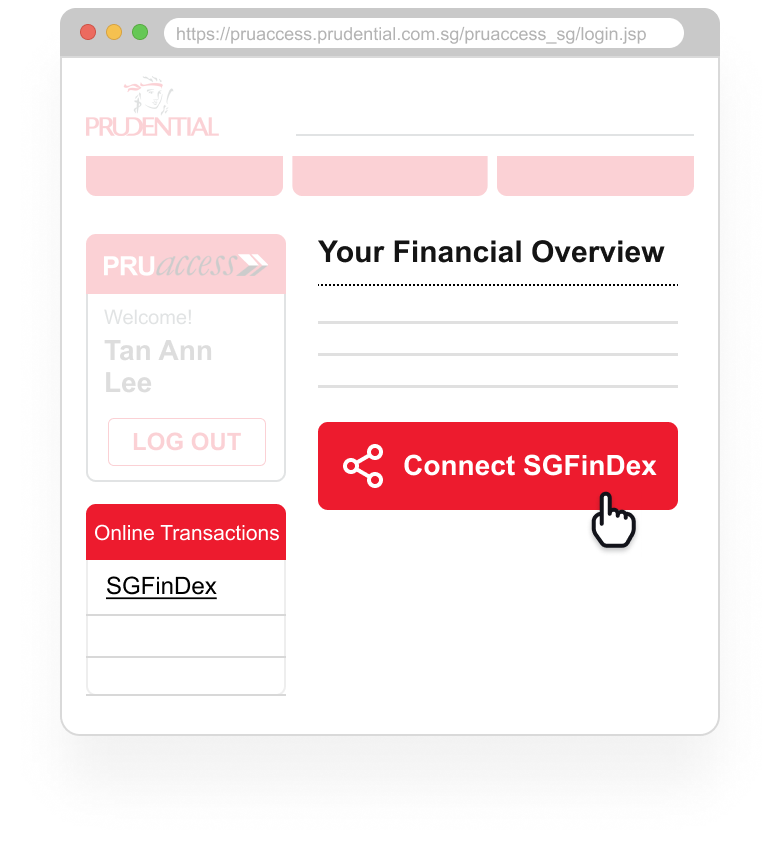

Login to PRUaccess.

Under Online Transactions, click on SGFinDex.

On Your Financial Overview page, click on Connect SGFinDex where you will be taken to SGFinDex platform.

Choose Financial Institutions

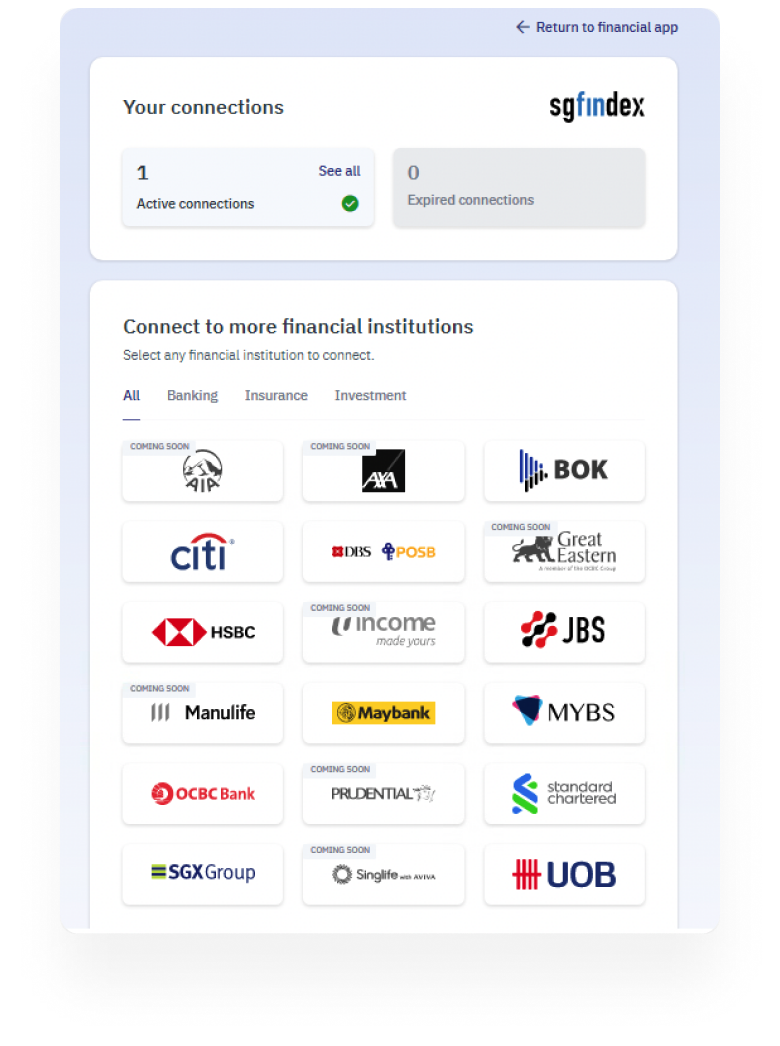

To protect your data, you need to authenticate and login with your Singpass account.

Select the financial institution you wish to connect to your SGFinDex.

You will be taken to the respective financial institution’s website to sign in.

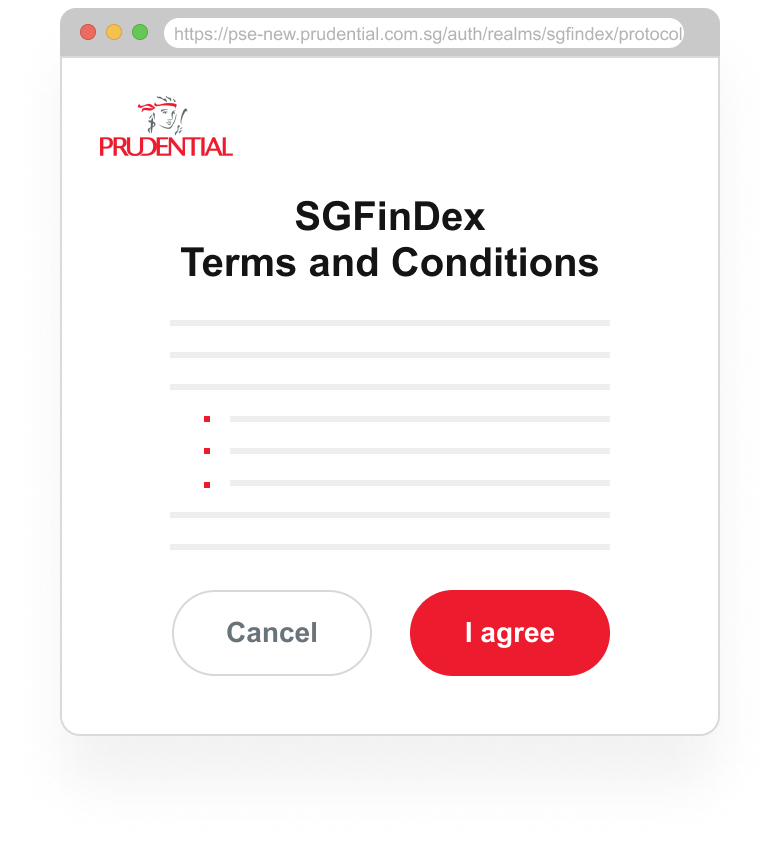

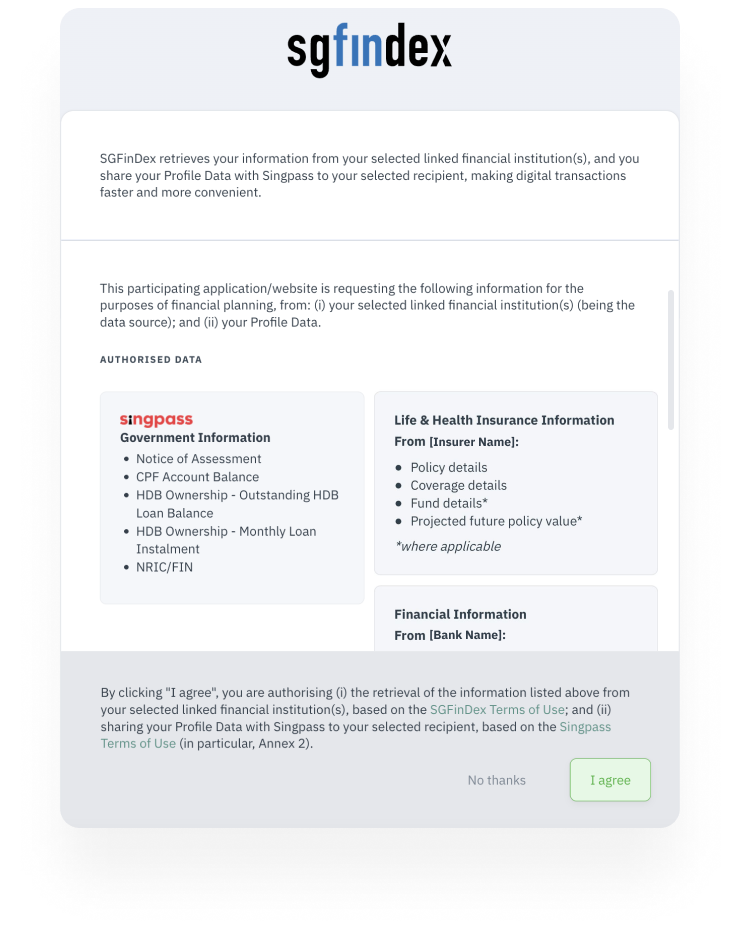

Provide Consent

Provide consent to the retrieval of data from your selected institutions and government accounts.

For verification, enter the OTP sent to your listed mobile device.

Your PRUaccess is successfully connected to your SGFinDex!

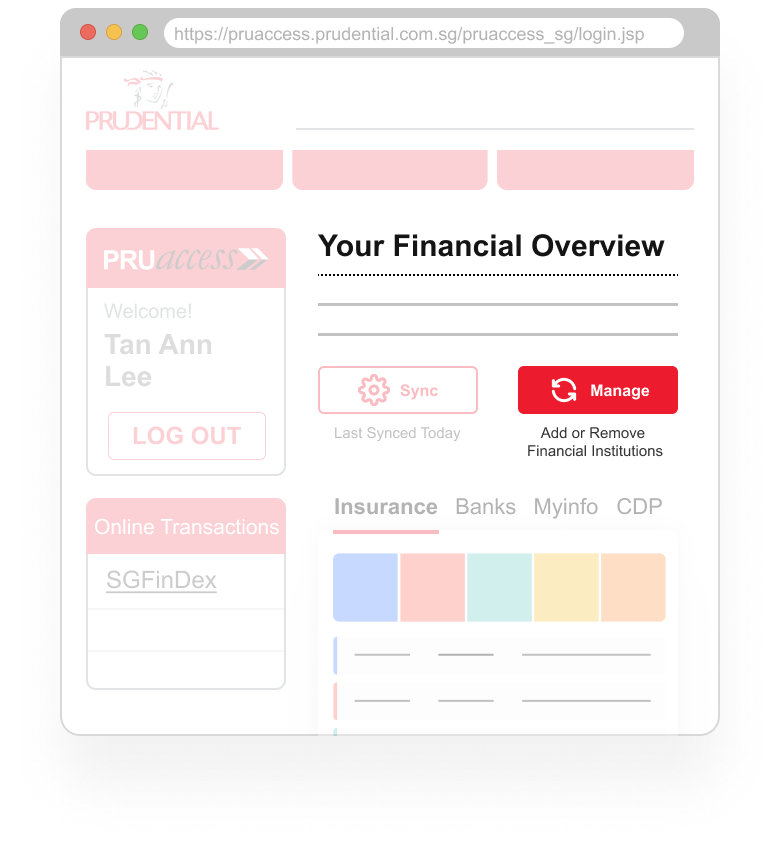

Sync Data

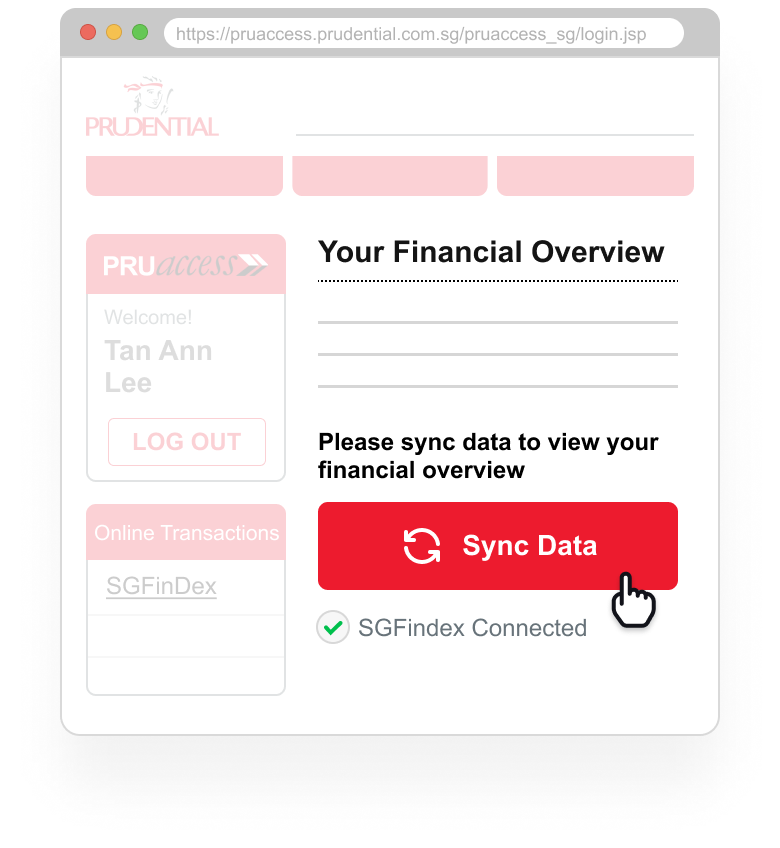

Sync

After connecting SGFinDex, Your Financial Overview page in PRUaccess will display that SGFinDex has been connected.

Proceed to Sync Data to retrieve your financial information, provide consent to the T&Cs.

You will be taken to GovTech’s website.

Consent

An authentication for your protection via Singpass is required to retrieve and display your data.

You will see the list of financial institutions you’ve previously selected to connect. Provide your consent and Agree to proceed.

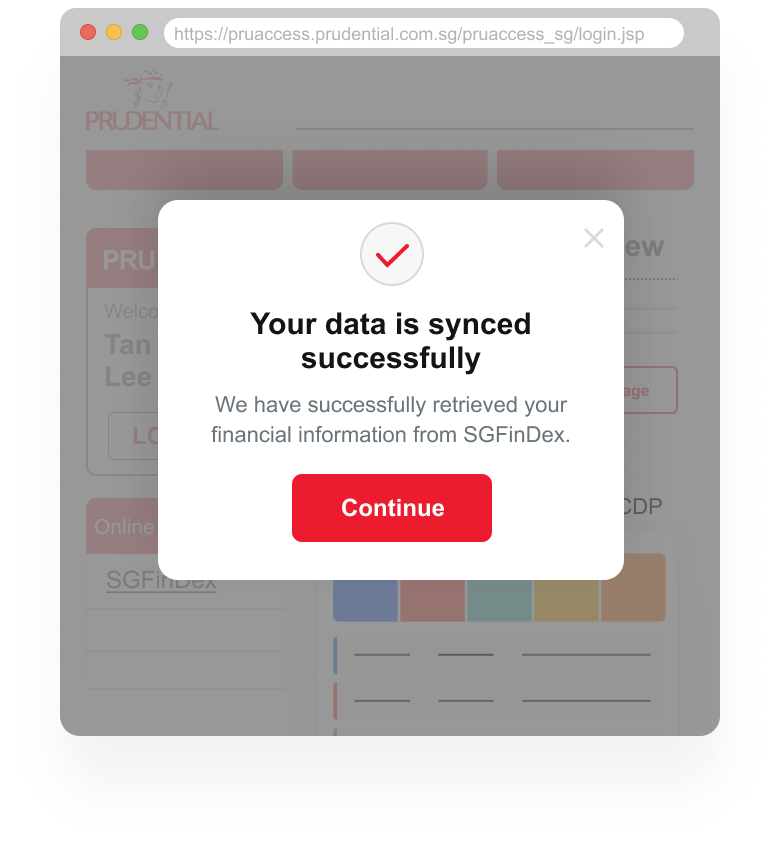

View

You will be taken back to PRUaccess as your data syncs.

After successfully syncing, your dashboard will be refreshed and you can now view your data in one consolidated view.

Revoke Connection

Manage

On Your Financial Overview page, click on Manage Financial Institutions to revoke connection, provide consent to the T&Cs.

You will be taken to GovTech’s website.

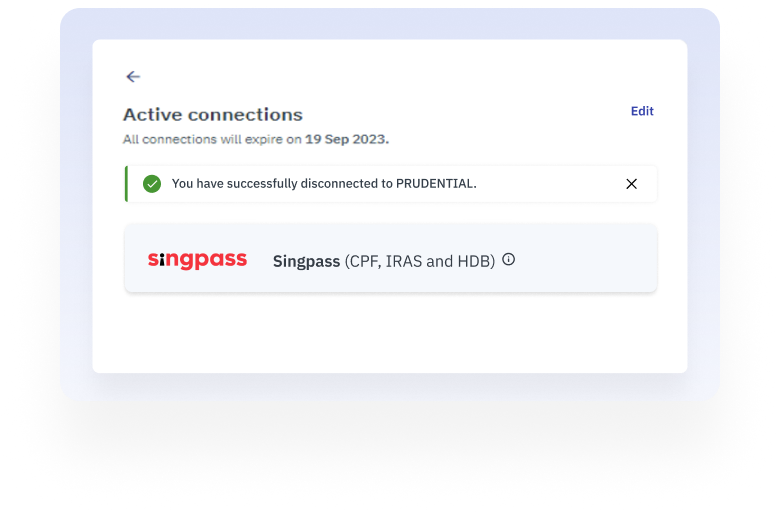

Disconnect

Login via Singpass to view the list of financial institutions that are connected.

Click Active Connections, and proceed to edit and select the financial institution you wish to disconnect.

You will be prompted to confirm your decision to disconnect. Proceed to Disconnect, and click on the back arrow to go back to SGFinDex’s financial institution list. Proceed to ‘Return to Financial App’.

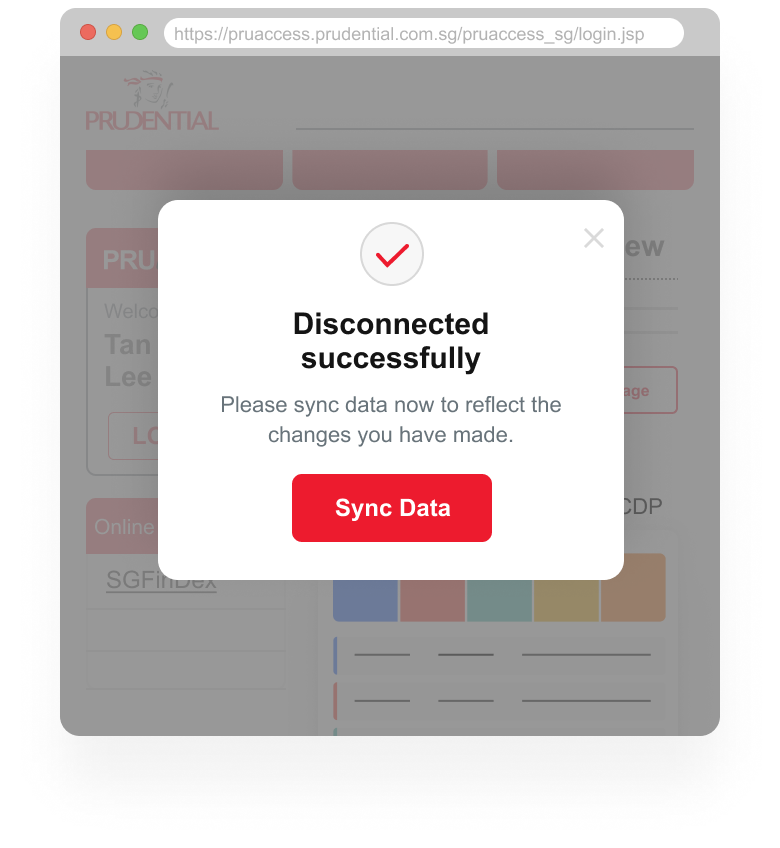

Refresh

You will be taken back to PRUaccess where you will see a popup displaying successful disconnection.

To display the changes you’ve made, refresh the dashboard by clicking on Sync Data, and repeat the steps necessary to sync.

Is SGFinDex safe?

Your data is encrypted when it is retrieved through SGFinDex and only the financial applications or websites that you have authorised to receive your data is able to decrypt the data. The authentication and authorisation process is underpinned by Singpass.

Start financial planning with a peace of mind and speak with a Prudential Financial Consultant today.

FAQ

How will my information be shared and will my Prudential policy information be shared with other insurers automatically?

You’ll need to first log in to SGFinDex platform via your financial applications or websites such as PRUaccess. Select an insurer or bank to connect and log in to that insurer or bank’s page with your account credentials to provide consent to link your financial accounts. Your information will only be shared through SGFinDex after you provide your consent to link your participating insurers or banks with SGFinDex and also request for information retrieval of the linked accounts.

Once that’s done, you’ll need to log in with your Singpass again as an added security measure. PRUaccess can then securely retrieve and store your information.

When you retrieve your information from other insurers or banks through PRUaccess, your Prudential policy information will NOT be automatically shared with other insurers or banks in return. SGFinDex does not store or have access to your financial information.

Who are the participating entities in SGFinDex?

Insurers: Prudential, AIA, HSBC-Life, Great Eastern, Manulife, Income and SingLife-Aviva

Banks: DBS/POSB, OCBC, UOB, Citibank, HSBC, Maybank and Standard Chartered Bank

Government Agencies: CPF, SGX/CDP, HDB and IRAS.

If my Insurer or Bank is not in the list above, what does it mean?

It means your insurer or bank is not a participant of SGFinDex and you would not be able to use SGFinDex to aggregate your financial information from the insurer or bank.

Is there a charge to use SGFinDex?

No, currently, you will not be charged for using SGFinDex via PRUaccess.

Can I use my PRUaccess to manage my account(s) with other Insurer or Banks?

No, you’ll only be able to view your information from the connected insurers, banks, CPF, SGX/CDP, HDB and IRAS. You won’t be able to perform any transaction.

How long does the consent for linkage of accounts last?

Your consent period will last for 1 year (365 days) from the time your first consent was provided. If you retrieve your data within the 1-year period, your consent period will be automatically extended to expire 1 year from the date you retrieved data by financial institutions whose systems support such extension.

For example, if you had provided consent to Bank A to provide your data through SGFinDex on 1st January 2023, and subsequently had provided consent to Bank B on 1st March 2023, all consents (i.e., consent to Bank A and B) will expire on 31st December 2023, if you did not retrieve your data before the expiry date.

If you retrieved your data on 5th April 2023, all consents (i.e., consent to Bank A and B) will be automatically extended for an additional 1 year from 5th April 2023 and will expire on 4th April 2024.

I have connected another insurer, but I don’t see it on PRUaccess, why is that?

There are two parts to complete in order to see your other insurers’ or banks’ information in PRUaccess. You are likely to have completed the first step of connecting your other insurers or banks and have possibly missed the second Singpass login to retrieve your information.

Here’s what you can do:

-

Go to PRUaccess.

-

Under Online Transations, click on SGFinDex.

-

On Your Financial Overview page, click on Sync Data to retrieve your financial information via GovTech’s website.

-

An authentication via Singpass is required to retrieve and display your data.

-

You will see the list of financial institutions you’ve previously selected to connect. Provide your consent and Agree to proceed.

-

You will be directed back to PRUaccess as your data syncs. After successfully syncing, your dashboard will be refreshed and you can now view your data in one consolidated view.

Why is the amount of insurance coverage and savings or loan balances different from what I see when I log into the respective financial institution applications or websites?

Information retrieved from SGFinDex from your connected financial institutions is based on the month-end data of the previous month. It is not real-time as displayed when you log into your respective financial institution applications or websites.

What are the measures in place to safeguard my data while it is being retrieved through SGFinDex?

There are stringent security measures in place to safeguard your personal data that passes through SGFinDex. Your data is encrypted when it is retrieved through SGFinDex and only the financial applications or websites that you have authorised to receive your data is able to decrypt the data. The authentication and authorisation process is underpinned by Singpass.

When you sync with SGFinDex, you will be able to see all your insurance policies in one place. This includes, but is not limited to:

Policy details, including surrender value and maturity date.

Coverage details, including plan type, sum insured, hospitalisation limit and coverage expiry.

Premium details, including premium mode frequency, premium payment term and total premium paid.

Payout details, including total accumulated income amount and payout frequency.

Fund details and its projection, including fund cash value and guaranteed value at maturity.

How is the coverage gap determined? Also, why are some categories of the Coverage Dashboard in color and some in grey?

You will see a coverage gap for the category that you do not hold any insurance product and this category on the Coverage Dashboard will be in grey color.

Each insurance category has a designated color label that is used to filter and sort the respective insurance policies that belongs to it (i.e., health protection policies from any insurer will have a blue color label, while life protection policies will have a red color label).

How do I use the coverage dashboard?

The coverage dashboard is interactive. By clicking on each category, you will get a deeper understanding of your insurance coverage(s).

Click on the colored category to see more information about your coverage.

The legend displays a colored check box when you have the coverage for that insurance sub-category. Grey checkbox with a ‘X’ indicates your coverage gap(s).

You can then choose to either contact your Financial Consultant, or to use PRUDiscovery and discover your needs deeper.

Why do I not see the coverage dashboard in my other SGFinDex accounts with other financial institutions?

We have created this view for you to gain a holistic view of your insurance coverage so that you can easily identify, and bridge any gap(s) you may have.

What are the categories and sub-categories for the Coverage Dashboard?

-

Life Protection

-

Death

-

Total Permanent Disability

-

Disability

-

-

Health Protection

-

Medical Hospitalisation

-

Accident

-

Critical illness

-

-

Wealth Accumulation

-

Savings

-

Investment

-

Retirement

-

-

Legacy Planning

-

Others (e.g., microinsurance products)

Do all my insurance policies fall under at least one of the categories and can the same policy fall under 2 different categories?

Yes, it will fall under either one or more of the categories depending on the nature of the insurance policy that you have. For any insurance product that does not fall into any of the 4 major categories, it will appear under Others (e.g., microinsurance).

My question is not addressed above, where can I find more information?

Please click here to see the complete list of Industry FAQs. If you need further assistance, you may call us at 1800 333 0333, Mondays to Fridays, 8.30am to 5.30pm (excluding Public Holidays). If you’re dialling from overseas or via a payphone, please call +65 6333 0333.