Glow into the future with possibilities, aspirations and opportunities for you and your loved ones. With our suite of plans to help you secure assurance against the unexpected and cultivate your wealth, you can now embrace life confidently without worries.

From 1 October to 31 December 2024, enjoy exclusive rewards as you protect what matters most.

#PRUVantage Wealth II is available in both SGD and USD currency. If it is a USD plan, the minimum annualised premium is in USD.

For more information, speak to your Prudential Financial Representative

or leave your contact details below.

Terms and Conditions of Glow with Confidence Promotion (“Promotion”)

- Promotion Details

-

Definitions:

- “Prudential” means Prudential Assurance Company Singapore (Pte) Limited.

- “Promotion Period” means the period between 1 October and 31 December 2024 (both dates inclusive).

- “Eligible Customer” means policyholder whose proposal for any Eligible Insurance Plan is submitted to and incepted by Prudential during the Promotion Period having satisfied the eligibility criteria below.

- “Eligible Insurance Plan/Eligible Single Premium Insurance Plan” means any of the products meeting the criteria as stated in the Promotion Table A, B, C and D below.

- “Campaign Period” means the duration of Promotion Bonus Units allocation to the Eligible Insurance Plan. For this promotion, the Promotion Bonus Units will be allocated within the Campaign Period of two (2) years during the first and second policy year, as long as due premiums are paid.

- “Discount” means the percentage discount given to the Eligible Customer as stated in the Promotion Table A and D below.

- “Promotion Bonus Units” means a percentage of the premium received for the basic policy that will be utilised to purchase additional units to be added to the Growth and/or Flex Account of the Eligible Insurance Plans for the first and second policy year as stated in the Promotion Table B below and will denote the same meaning as described under Section 5 below.

- “Reward” means digital gift voucher redeemable from participating merchants such as Dairy Farm, Deliveroo, Frasers Property, GrabGifts, Lazada, CapitaStar, NTUC FairPrice and Marriott. Please note that these merchants are subject to change.

- “Promotion Table” means Promotion Table A, B, C and D below.

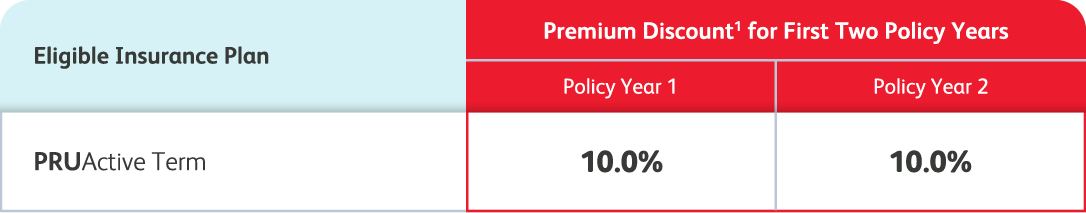

Promotion Table A

Eligible Insurance Plan Premium Discount1 Protection PRUActive Term 10% for Policy Year 1

10% for Policy Year 2

Note: Ascend and Opus by Prudential customers and their families will be eligible for an additional 10%2 off first-year premium on purchase of PRUActive Term if they pay premiums on annual mode.

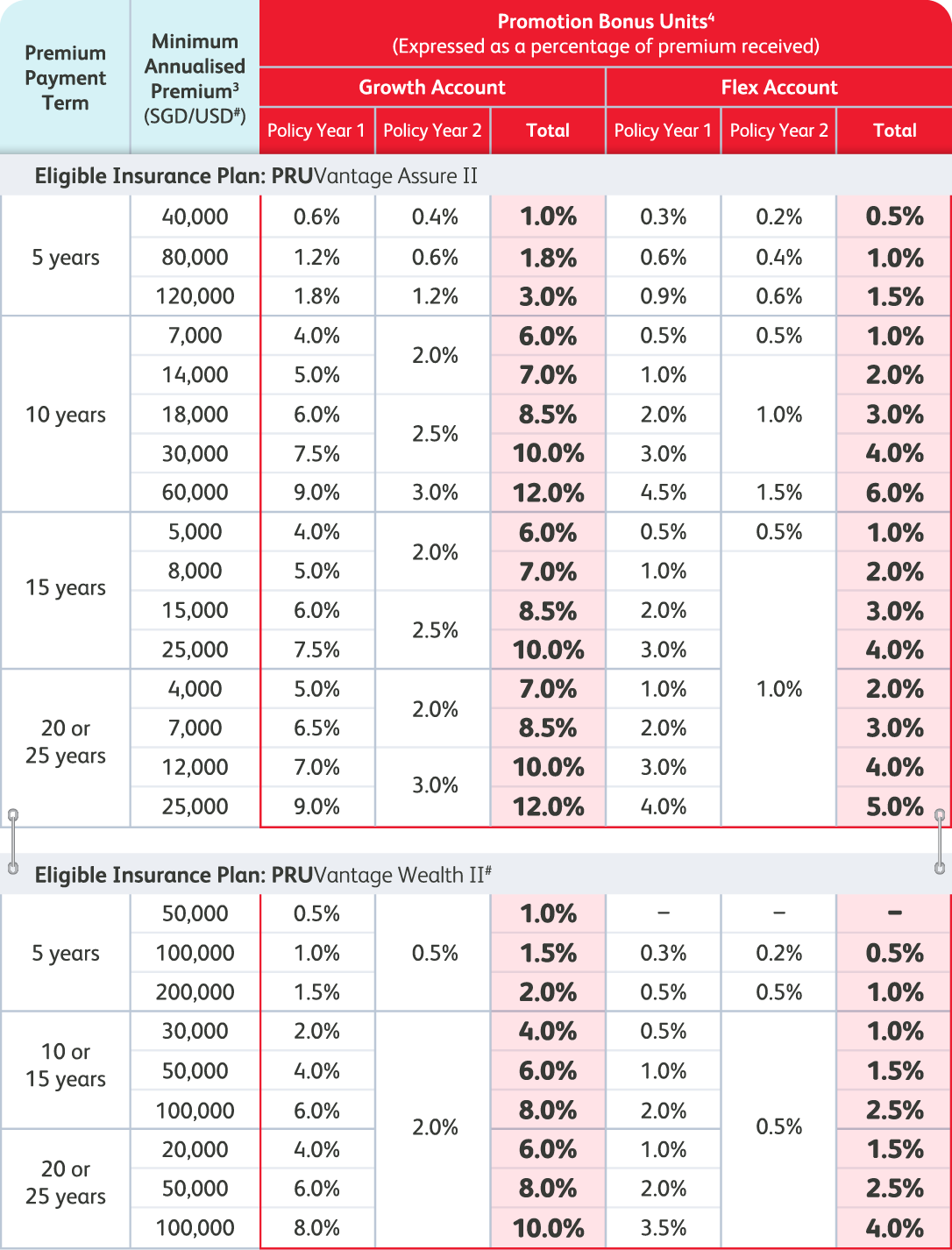

Promotion Table B

Eligible Insurance Plans Premium Payment Term Minimum Annualised Premium3 (SGD/USD#) Promotion Bonus Units4

(Expressed as a % of premium received)Growth Account Flex Account Policy Year 1 Policy Year 2 Total Policy Year 1 Policy Year 2 Total Investments PRUVantage Assure II 5 years 40,000 0.6% 0.4% 1.0% 0.3% 0.2% 0.5% 80,000 1.2% 0.6% 1.8% 0.6% 0.4% 1.0% 120,000 1.8% 1.2% 3.0% 0.9% 0.6% 1.5% 10 years 7,000 4.0% 2.0% 6.0% 0.5% 0.5% 1.0% 14,000 5.0% 2.0% 7.0% 1.0% 1.0% 2.0% 18,000 6.0% 2.5% 8.5% 2.0% 1.0% 3.0% 30,000 7.5% 2.5% 10.0% 3.0% 1.0% 4.0% 60,000 9.0% 3.0% 12.0% 4.5% 1.5% 6.0% 15 years 5,000 4.0% 2.0% 6.0% 0.5% 0.5% 1.0% 8,000 5.0% 2.0% 7.0% 1.0% 1.0% 2.0% 15,000 6.0% 2.5% 8.5% 2.0% 1.0% 3.0% 25,000 7.5% 2.5% 10.0% 3.0% 1.0% 4.0% 20 or 25 years 4,000 5.0% 2.0% 7.0% 1.0% 1.0% 2.0% 7,000 6.5% 2.0% 8.5% 2.0% 1.0% 3.0% 12,000 7.0% 3.0% 10.0% 3.0% 1.0% 4.0% 25,000 9.0% 3.0% 12.0% 4.0% 1.0% 5.0% PRUVantage Wealth II# 5 years 50,000 0.5% 0.5% 1.0% 0.0% 0.0% 0.0% 100,000 1.0% 0.5% 1.5% 0.3% 0.2% 0.5% 200,000 1.5% 0.5% 2.0% 0.5% 0.5% 1.0% 10 or 15 years 30,000 2.0% 2.0% 4.0% 0.5% 0.5% 1.0% 50,000 4.0% 2.0% 6.0% 1.0% 0.5% 1.5% 100,000 6.0% 2.0% 8.0% 2.0% 0.5% 2.5% 20 or 25 years 20,000 4.0% 2.0% 6.0% 1.0% 0.5% 1.5% 50,000 6.0% 2.0% 8.0% 2.0% 0.5% 2.5% 100,000 8.0% 2.0% 10.0% 3.5% 0.5% 4.0% # PRUVantage Wealth II is available in both SGD and USD currency. If it is a USD plan, the minimum annualised premium is in USD.

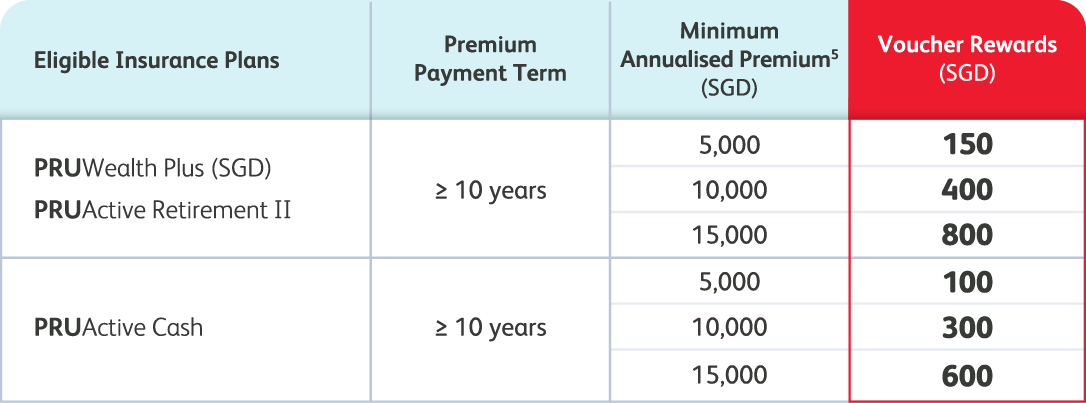

Promotion Table C

Eligible Insurance Plan Premium

Payment TermMinimum

Annualised

Premium5 (SGD)Voucher Reward

(SGD)Insurance Savings PRUWealth Plus (SGD)

PRUActive Retirement II≥ 10 years 5,000 150 10,000 400 15,000 800 PRUActive Cash ≥ 10 years 5,000 100 10,000 300 15,000 600

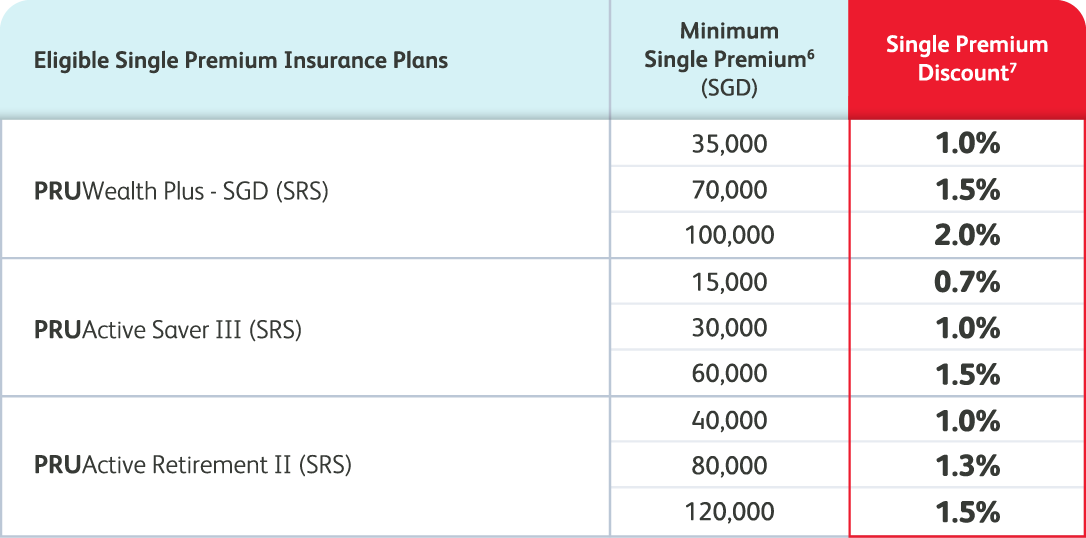

Promotion Table D

Eligible Single Premium Insurance Plans Minimum Single

Premium6 (SGD)Single Premium

Discount7Insurance Savings - Supplementary Retirement Scheme (SRS) PRUWealth Plus (SGD) - SRS 35,000 1.0% 70,000 1.5% 100,000 2.0% PRUActive Saver III (SRS) 15,000 0.7% 30,000 1.0% 60,000 1.5% PRUActive Retirement II (SRS) 40,000 1.0% 80,000 1.3% 120,000 1.5%

-

Eligibility

To be eligible for the Promotion, the Eligible Customer has to satisfy the following requirements in order to receive the Discount/Reward/Promotion Bonus Units (as defined in the Promotion Table A, B, C and D):

- The Eligible Customer’s proposal for an Eligible Insurance Plan is submitted to and incepted by Prudential during the Promotion Period.

- This Promotion is valid for all premium payment modes (monthly, quarterly, half-yearly, and annually) as applicable to the Eligible Insurance Plan except for insurance savings using Supplementary Retirement Scheme in Promotion Table D which is valid for single premium mode only.

- Ascend and Opus by Prudential customers and their family will enjoy an additional 10% off first-year premium for PRUActive Term submitted to and incepted by Prudential during the Promotion Period. To enjoy the discount, the first-year premium of the Eligible Insurance Plan must be paid on an annual basis.

- The Discount/Reward/Promotion Bonus Units is not applicable should the Eligible Insurance Plan be Not Taken Up and subsequently reopened, or the Eligible Insurance Plan has lapsed and subsequently reinstated.

- If the Eligible Customer's proposal for any Eligible Insurance Plan fulfils the criteria of other promotions carried out by Prudential, the promotion with the higher value will be granted to the Eligible Customer (unless otherwise stated).

-

Discount

- An Eligible Customer is entitled to receive the Discount in accordance with Promotion Table A and D above.

- For PRUActive Term, the Discount will be applied on the total premiums payable for the basic policy and supplementary benefit(s), including the additional premiums payable due to substandard loadings, in each of the first and second policy year. For the avoidance of doubt, increased premium that comes with the Incremental Sum Assured benefit (where applicable) will not be entitled to the premium discount.

- For PRUWealth Plus (SGD) - SRS, PRUActive Saver III (SRS) and PRUActive Retirement II (SRS), the Discount will be in the form of single premium discount applied on the total premiums paid for the basic policy.

- The Discount in this Promotion shall be on a ‘per-policy’ basis subject to the Terms and Conditions of this Promotion.

- The Discount in this Promotion is not applicable should the Eligible Insurance Plans be cancelled within the fourteen (14) day free-look period. The premium amount refunded will be based on the premium amount paid by the Eligible Customer.

- The Discount will be applied automatically at policy issuance upon meeting the eligibility criteria.

- The Discount is not applicable should the Eligible Insurance Plan be Not Taken Up and subsequently reopened, or the Eligible Insurance Plan has lapsed and subsequently reinstated.

-

Reward

- An Eligible Customer is entitled to receive the Reward in accordance with Promotion Table C above.

- Each Eligible Customer is entitled to a maximum of one (1) Reward for the same life assured covered under the Eligible Insurance Plan(s).

-

Promotion Bonus Units Allocation

- An Eligible Customer is entitled to receive the Promotion Bonus Units in accordance with Promotion Table B above.

- The Promotion Bonus Units in this promotion is not applicable should the Eligible Insurance Plan be cancelled within fourteen (14) day free-look period, is surrendered (including partial withdrawal) during the Campaign Period or be subjected to a death claim under suicide or pre-existing conditions within twelve (12) months from the cover start date. The promotion bonus units will be withheld, and the value of these units will not be paid to the Eligible Customer.

- The Promotion Bonus Units will be credited to the Growth and/or Flex Account automatically at policy issuance and upon receipt of subsequent first and second policy year premiums by Prudential. The allocation to the Growth and/or Flex Account will be in the same account allocation chosen by the Eligible Customer.

- Once credited, the Promotion Bonus Units under this Promotion will be added into the Growth and/or Flex account value and will be subject to the terms and conditions of this promotion.

- The promotion bonus unit value refers to the dollar value used to compute the Promotion Bonus Units. It is expressed as a percentage of the premium received by Prudential for the basic policy in the first and second policy year, excluding any premiums paid for supplementary benefits or top-ups via the Investment Booster (Lump Sum), rounded to two decimal points.

- The promotion bonus unit value is used to compute the number of Promotion Bonus Units based on the fund selection(s) / premium direction and the next working day’s fund unit price(s) (T + 1) from the policy inception date (T).

- If there is a subsequent request for fund switch/premium re-direction, the Promotion Bonus Units will be computed based on the next working day’s fund unit price (T + 1) following the fund switch (T) or upon receipt of premium following premium re-direction (T).

- The Promotion Bonus Units shall be on a ‘per-policy’ basis subject to the Terms and Conditions of this Promotion.

- Eligible Customers will be notified via the Statement of Account on the successful crediting of the Promotion Bonus Units to their fund holdings.

- Please refer to the detailed Terms and Conditions of the Promotion Bonus Units available on https://www.prudential.com.sg/TnCs/promobonusunits.

- By participating in the Promotion, each Eligible Customer is deemed to have accepted and agreed to be bound by these Terms and Conditions contained herein and any other instructions, terms and conditions that Prudential may issue from time to time.

- Prudential assumes no responsibility for incomplete, lost, late, damaged, illegible or misdirected forms or email communication, for technical hardware or software failures of any kind, lost or unavailable network connections, or failed incomplete, garbled or delayed electronic transmission which may limit an Eligible Customer’s ability to participate in the Promotion.

- Prudential has the sole and absolute discretion to exclude any Eligible Customer from participating in the Promotion without any obligation to furnish notice and/or reason.

- Prudential reserves the right to disqualify or disregard any Eligible Customer who does not comply with the Terms and Conditions.

- Prudential may at its discretion forfeit the Discount/Reward/Promotion Bonus Units, or, if already awarded, reclaim the Discount/Reward/Promotion Bonus Units at the expense of the Eligible Customer without payment, compensation, or having to give any reason whatsoever in the event Prudential subsequently discovers that the Eligible Customer is not eligible to participate in the Promotion and/or to receive the Discount/Reward/Promotion Bonus Units.

- Rewards are subject to availability while stocks last. Prudential reserves the right to replace any Discount/Reward/Promotion Bonus Units with items of similar value at any time without prior notice.

- Prudential shall not be liable for any loss of, damage to, defects, delay, mis-delivery or non-delivery of the Discount/Reward/Promotion Bonus Units.

- Prudential reserves the right to deal with any unclaimed Discount/Reward/Promotion Bonus Units in any manner it deems fit. Prudential reserves the right to request for the Eligible Customers’ proof of eligibility, identity and/or otherwise for the purposes of verifying the Eligible Customer’s claim to the Discount/Reward/Promotion Bonus Units at the time of Discount/Reward/Promotion Bonus Units allocation. Prudential is under no obligation whatsoever to disclose the identity of the Eligible Customers or to publish the same for any reason at any point of time.

- The Discount/Reward/Promotion Bonus Units are not exchangeable for cash, credit or any other items of equivalent value. The validity period of the Discount/Reward/Promotion Bonus Units is non-extendable. Prudential will be under no obligation to replace or pay to Eligible Customers the value of any Discount/Reward/Promotion Bonus Units that that are not utilised by the Eligible Customers before the end of the validity period of the Discount/Reward/Promotion Bonus Units as may be stipulated by Prudential and/or relevant merchants.

- The Promotion is not valid in conjunction with other promotions carried out by Prudential.

- By participating in this Promotion, each Eligible Customer agrees and consents under the Personal Data Protection Act (Cap 26 of 2012) to the collection, use and disclosure of any and all personal data of the Eligible Customer by/to Prudential, advertising and promotional agencies of the Promotion and such other third party, in Prudential’s absolute discretion, consider appropriate or necessary in connection with the Promotion and redemption of Discount/Reward/Promotion Bonus Units.

- If an Eligible Customer provides Prudential with personal data of any third party, that Eligible Customer hereby:

- Agrees on behalf of that third party to be bound by the Terms and Conditions contained herein; and

- Consents on behalf of that third party, to Prudential’s collection, use, disclosure and processing of his/her personal data in accordance with the Terms and Conditions contained herein.

- Prudential shall not be liable for any third party’s misuse of the Eligible Customer’s submitted information and photograph as a result of the Eligible Customer taking part in the Promotion.

- Unless prohibited by law, participation in the Promotion constitutes permission for Prudential, its advertising and promotional agencies to use any of the Eligible Customer’s names, and/or likeness for advertising and promotional purposes. Each Eligible Customer further agrees and acknowledges that the copyright and all other intellectual property rights in and to all photographs or audio-video or other recordings of the Eligible Customer taken or made in connection with the Promotion shall vest solely and absolutely in Prudential without any compensation to the Eligible Customer.

- Prudential may at any time at its absolute discretion, without prior notice or assigning any reason thereof or being liable to any person, (i) suspend, cancel or terminate the Promotion, or (ii) delete, vary, supplement, amend, modify any one or more of the terms and conditions of the Promotion. Prudential’s determination of all matters in connection with the Promotion and the Discount/Reward/Promotion Bonus Units shall be final, binding and conclusive. Prudential is not obliged to give any reason or prior notice on any matter concerning the Promotion or the Discount/Reward/Promotion Bonus Units. No appeal, correspondence or claims will be entertained. Prudential has the right and discretion to determine whether a party has met the requirements of the Promotion and/or to receive the Discount/Reward/Promotion Bonus Units. Eligible Customers shall not be entitled to any damages or compensation whatsoever or howsoever arising as a result of such amendment, suspension or termination.

- By participating in the Promotion, all Eligible Customers agree and undertake to, at all times, indemnify, keep indemnified, and hold Prudential, its employees and agents harmless against all losses (including direct, indirect, incidental and/or consequential losses), damages (including general, special, and/or punitive damages), demands, injuries (other than personal injury caused by Prudential’s negligence), claims, costs, penalties, interest and fees (including all legal fees as between solicitor and client or otherwise on a full indemnity basis whether or not incurred in respect of any real, anticipated, or threatened legal proceedings), howsoever caused by, arising or resulting from, whether directly or indirectly, their participation in the Promotion, acceptance or usage of any Discount/Reward/Promotion Bonus Units, and/or any breach or purported breach of these terms and conditions and/or any applicable law.

- Prudential makes no warranty or representation as to the quality, merchantability or fitness for the purpose of the merchants’ goods and services in respect of the Reward. Any dispute about the same must be resolved directly with the merchant. Merchant terms and conditions apply.

- In the event of any inconsistency or discrepancy between the Terms and Conditions and the contents of any brochure, marketing and/or promotional materials relating to the Promotion, these Terms and Conditions shall prevail.

- Any trademarks, graphic symbols, logos or intellectual property contained in any materials used in connection with this Promotion, in particular the Discount/Reward/Promotion Bonus Units, are the property of their respective owners. Prudential is not affiliated with, or endorsed or sponsored by, such owners and their relevant affiliates.

- Failure by Prudential to exercise any of its right or remedy under these Terms and Conditions does not constitute a waiver of that right or remedy.

- The Terms and Conditions shall be governed by Singapore law and the Eligible Customers agree to submit to the exclusive jurisdiction of the courts of Singapore.

- A person who is not a party to any agreement governed by these terms and conditions shall have no right under the Contracts (Right of Third Parties) Act (Cap 53B) to enforce any of these terms and conditions.

B. General Terms and Conditions

Footnotes

Important Notes

You are recommended to read the product summary and seek advice from a qualified Prudential Financial Representative for a financial analysis before purchasing an insurance policy suitable to meet your needs.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. Premiums for some of the supplementary benefits are not guaranteed and may be adjusted based on future claims experience.

As PRUActive Term (regular pay) has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

PRUVantage Assure II and PRUVantage Wealth II are Investment-Linked Plans (ILP) which invest in ILP sub-fund(s). Investment products are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units and the income accruing to the units (if any) may fall or rise. Past performance is not necessarily indicative of future performance.

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from your Prudential Financial Representative. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

The information contained herein is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details, and exclusions applicable to these insurance products in the policy documents that can be obtained from your Prudential Financial Representative.

The information contained herein is for distribution in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

The information presented cannot be reproduced, amended or circulated in whole or in part to any other person without our prior written consent.

Information is correct as of 1 October 2024.

This advertisement has not been reviewed by the Monetary Authority of Singapore.