PRUActive Protect

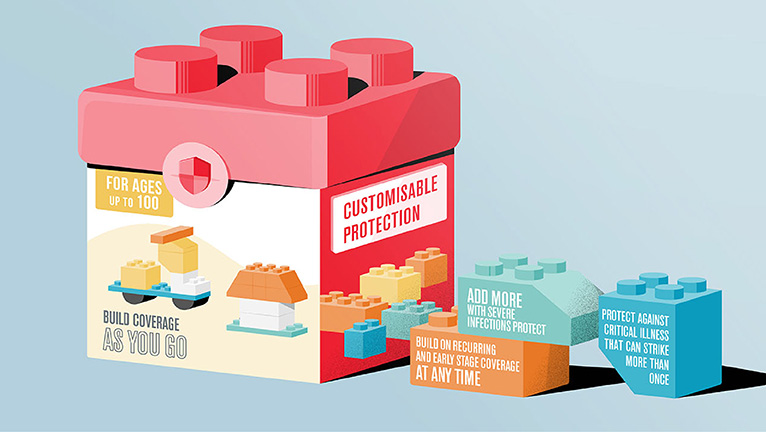

PRUActive Protect is a customisable critical illness insurance plan that supports you during difficult times. The plan is designed to grow with you through life. Find out more in our Build to Grow video.

What is PRUActive Protect?

PRUActive Protect is a customisable critical illness insurance plan that allows you to choose a policy term from 10 years up to 99 years and get critical illness coverage against 37 life-threatening illnesses up to age 100. It can continue to protect you for repeated illnesses, right from diagnosis.

The plan is designed to grow with you through life by providing you with the flexible option to add on coverage against pre-critical stage, recurring and relapse critical illness conditions and more, as and when your needs, priorities and budget grows.

Key Benefits

Supplementary benefits

Protect Plus

Claim up to 500%4 of your basic critical illness benefit sum assured by restoring your basic critical illness benefit sum assured to 100% after a critical illness benefit claim.

Early Protect

Get coverage against all pre-critical stage critical illnesses and receive a lump sum payout upon pre-critical stage critical illness diagnosis5.

Early Protect Plus

Claim up to 500% of your Early Protect sum assured by restoring your Early Protect sum assured to 100% after a pre-critical stage critical illness benefit claim6.

Life Protect Plus

Receive an additional lump sum payout for death benefit up to 100% of your basic critical illness coverage7.

Severe Infections Protect

An additional lump sum payout when you are diagnosed with a serious infectious disease8 and is admitted to ICU for 5 or more consecutive days because of the infection.

Monthly Benefit

Receive monthly payouts9 between S$100 to S$5,000 for a period of either 1, 2 or 3 years on top of your lump sum payout when diagnosed with a critical illness.

Important information

Footnotes

Additional Notes

You are recommended to read the product summary and seek advice from a qualified Prudential Financial Consultant, or a distributor duly appointed by Prudential Singapore for a financial analysis before purchasing a policy suitable to meet your needs.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. Premiums are not guaranteed and may be adjusted based on future claims experience.

The information on this website is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details and exclusions applicable to this insurance product in the policy documents which can be obtained from your Prudential Financial Consultant. The information contained on this website is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

In case of discrepancy between the English and Mandarin versions of the product brochures, the English version shall prevail.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

Information is correct as of 29 December 2023.

This advertisement has not been reviewed by the Monetary Authority of Singapore.