As a parent, your child’s health and safety are always your top priority. Apart from showering your child with love and providing dedicated caregiving, it is also vital for parents to ensure your child has adequate medical insurance coverage to stay protected against unexpected emergencies, especially with the continuous rise in healthcare cost in Singapore. Here are some key reasons you should consider an Integrated Shield Plan for your child as the first insurance policy.

Integrated Shield Plan for your child

Children tend to fall sick or get injured easily, especially during the first few years of their lives. Common childhood illnesses such as colds, flu and viral infections can sometimes lead to hospitalisation. When faced with such unexpected medical situations, all you want is to focus your time and energy on your sick child instead of having to worry about finding quality healthcare providers and whether you can afford the medical bills.

However, the cost of hospitalisation for a child in Singapore can be high and variable, depending on various factors like the choice of hospital, the length of stay, the type of ward and the medical procedures performed.

As an example, the cost of hospitalisation for a child for three days in a basic private room can go up to S$1,8281 at a government restructured hospital specialising in healthcare for women and children and S$2,5742 at a high-end private hospital. In addition, the costs of medical procedures like blood tests and scans can range from the hundreds to thousands. This could add up to a substantial amount that could come as a bill shock to many parents.

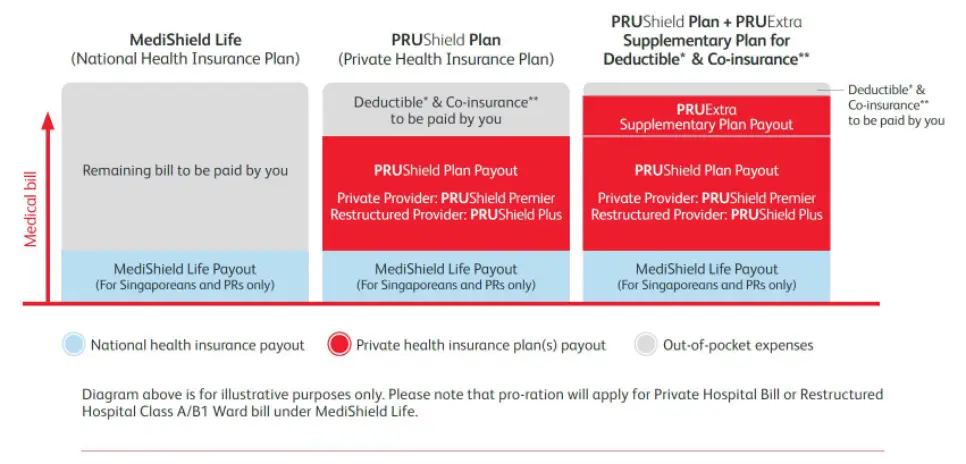

If your child is a Singaporean or Permanent Resident, he or she will be protected by the government basic health insurance plan known as MediShield Life. By complementing the MediShield life with an Integrated Shield Plan such as PRUShield, you can get better protection and healthcare services for your child. With PRUShield, you can claim higher annual coverage of up to S$2 million3 for hospital bills and have an option of letting your child seek treatment at a private hospital. This way, you are provided with more treatment options without having to worry about medical costs and can focus on taking care of your sick child.

PRUShield – Better healthcare coverage, for better lives

When considering buying health insurance plans for children, make sure you assess your requirements, budget and medical history. With a suitable and adequate health insurance plan, you do not have to worry about dipping into your savings or retirement funds to pay for your child’s medical costs.

PRUShield is one of the most popular health insurance plans with its comprehensive coverage, competitive premiums and various options that cater to customers’ budget and healthcare preferences.

PRUShield covers a wide range of medical expenses such as hospitalisation, surgery and outpatient treatment. It offers an ideal solution for parents who want to ensure their children have access to quality healthcare without worrying about the high cost of medical expenses. Additionally, PRUShield offers coverage for outpatient treatments, pre- and post-hospitalisation, including consultations, treatments and laboratory services. To give you more reassurance, PRUShield uniquely offers up to S$1.2 million in coverage that can be refreshed if you use up the limit and need to claim for a condition that is different from previous claims within the same policy year. Parents can also further cap their hospital bill at S$3,000 at Panel providers4, Extended Panel (EP) specialists5 and in cases of emergency, by adding a PRUExtra supplementary plan for wider coverage on deductibles and co-insurance.

In addition, PRUShield offers a wide range of customisable coverage options, meaning parents can choose a plan that fits their individual budget and healthcare needs. Parents can choose from different coverage levels or options that provide lesser out-of-pocket expenses to create a health insurance plan specifically tailored to their requirements.

Enjoy more affordable and competitive premiums with our first-in-industry (Prudential is the first to launch this in 2019) claims-based pricing on eligible supplementary plans if you stay healthy and don’t make claims, because your premiums will be determined by your claims activities in the year before.

Plus, by adding an eligible supplementary plan, PRUShield customers can enjoy the greater convenience of PRUPanel Connect – a suite of value-added services at Prudential’s range of participating hospitals/day surgery centres and specialists, which includes appointment bookings, cashless transactions, concierge services and more. As priority jugglers, parents may find this convenience relevant as their priority is to get the needed treatment for their children as soon as possible.

Below is an illustration of how a PRUExtra supplementary plan helps to keep your out-of-pocket expenses to the minimum.

Source: Prudential PRUShield Product Brochure

Overall, PRUShield is an excellent health insurance plan to consider for your children. With comprehensive medical insurance coverage options, access to a network of healthcare services and various wellness programmes and services, parents can ensure their child’s health is in good hands.

Have an existing health insurance plan that doesn’t fit your needs? Make the switch to PRUShield with PRUShield EasySwitch, where you can enjoy simplified sign-up and continued coverage for a seamless and worry-free transition. Terms and conditions apply.

Purchasing insurance for your child is a major decision and a long-term commitment. To find out more on PRUShield and other types of insurance that best suit the needs of you and your family, speak with a Prudential Financial Representative for a non-obligatory consultation.

Footnotes:

Disclaimer:

This article is for your information only and does not consider your specific investment objectives, financial situation or needs. We recommend that you seek advice from a Prudential Financial Consultant before making a commitment to purchase a policy. T&Cs apply. Protected up to specified limits by SDIC. Information is correct as at 15 May 2024.