From infrastructure assets to local currency bonds, discover where long-term investment opportunities lie.

Adapted from abrdn Investments, Diversified assets: a new regime needs a fresh approach, dated as of 17 June 2024

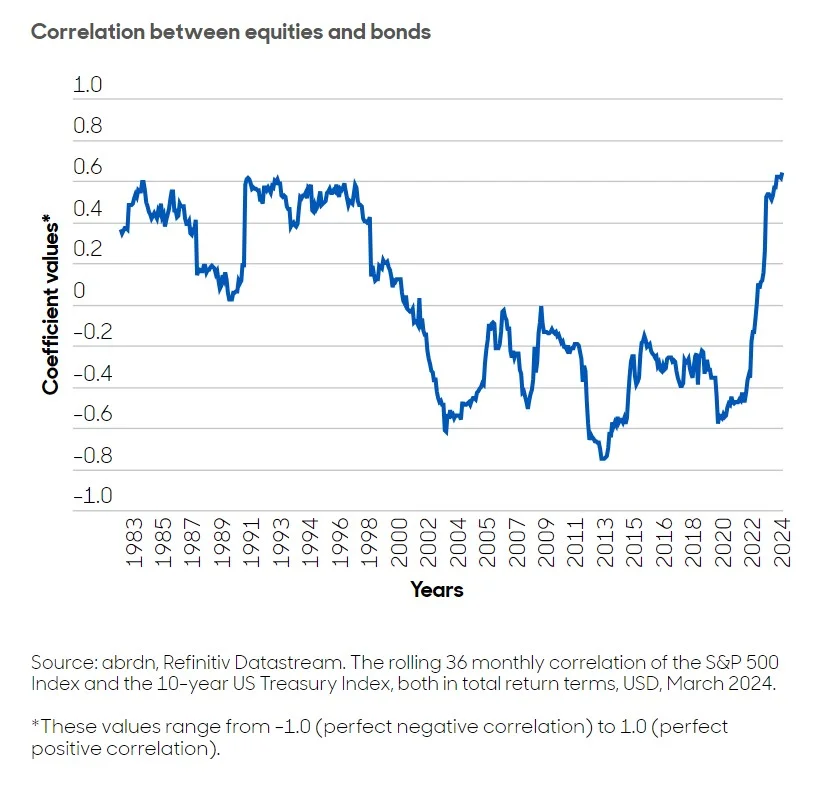

For much of the past decade, the investment landscape has been marked by falling interest rates and low inflation. This environment has traditionally favoured a balanced ‘60/40’ portfolio — investing 60% in stocks and 40% in bonds. While this strategy relies on stocks for growth and bonds for stability during market downturns, the dynamics changed dramatically in 2022. As central banks raised interest rates to combat rising inflation, both stocks and bonds saw declines at the same time, contrary to expectations that bonds would provide a safety net.

Recently, the stock market has rebounded, driven by a few technology companies and solid economic growth. However, bonds continue to face challenges. Despite the US Federal Reserve’s interest rate cut in September1, inflation remains high. Still, the strength in stocks has helped revive the traditional ‘60/40’ portfolio strategy.

Today, equity markets are more concentrated, meaning a smaller number of companies hold significant weight. For example, US companies represent 63% of the MSCI AC World index, and the technology sector alone accounts for 23% of it. This concentration can be risky, especially since valuations in the stock market are high, leaving little room for error if company earnings falter.

On the other hand, bond yields have become more attractive than they have been in the past decade2, potentially benefiting from the recent rate cut in September. This shift presents a better opportunity for diversification. However, unless inflation drops further, it may be necessary for investors to adjust their expectations about how bonds will perform against weaker stock markets.

Given these changes, many investors are looking for smarter ways to build resilient portfolios. There’s a growing demand for diverse sources of growth and income — especially portfolios that may deliver solid long-term returns while remaining stable during market fluctuations. This is where the PRULink Global Diversified Income Fund comes in. It offers an innovative solution by investing in a mix of traditional and alternative assets, aiming for both income and growth.

Diversified assets

The PRULink Global Diversified Income Fund takes an unconstrained and flexible approach to investing with the aim of achieving attractive long-term income and capital growth across different economic conditions.

By investing in a variety of asset classes, the fund seeks to lower short-term volatility and reduce reliance on any one type of investment for income and returns. Over the last decade, the availability of alternative investment opportunities has grown significantly, providing new ways to diversify portfolios.

While the fund is designed for long-term growth, it also adapts to changing market conditions. The Underlying Fund Manager from abrdn Investments actively monitors asset performance, striving to make the best choices for risk-adjusted returns by leveraging extensive expertise in various asset classes.

Outlook

Based on current market conditions, listed equities may not offer great value right now due to high starting prices. For example, US stocks are currently expensive compared to historical averages. While there are positive trends, such as the potential benefits of artificial intelligence, there are also risks that investors should be cautious of.

In recent years, bonds have not been seen as strong investments due to low expected returns. However, rising interest rates have made bond yields more appealing. As central banks eventually work towards lowering rates again, this may support bond returns. Still, the path may be bumpy, and while credit investments might seem attractive, they are also subject to risks.

Instead of solely relying on traditional investments, there are many long-term opportunities in a broader range of asset classes, including:

- Infrastructure Assets: These may offer growth potential and stable cash flows that often keep pace with inflation. Current valuations suggest they could provide strong returns over time.

- Local Currency Emerging Market Bonds: These bonds may offer good returns and diversification advantages.

- Floating-Rate Asset-Backed Securities: These provide higher credit spreads compared to corporate credit, along with protection from defaults.

- Special Opportunities: This category includes unique investments, such as healthcare royalties or litigation finance, which rely on specific factors rather than broader economic conditions.

With the PRULink Global Diversified Income Fund, investors can tap into a well-rounded investment strategy that aims to deliver long-term income and capital growth while adapting to changing market dynamics.

To find out more, speak with a Prudential Financial Representative today.

1 We finally got a rate cut. Here’s what history says will happen next. CNN Business.

2 What the Fed’s Rate Cut Means for Bond Investors. Morningstar.

Disclaimer:

abrdn Investments

Investment involves risk. The value of an investment and any income from it is not guaranteed and can go down as well as up. The information provided in this article is for general informational purposes only and does not constitute professional financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Prudential Singapore

A Product Summary, Fund Information Booklet and Product Highlights Sheet relating to the Fund are available and may be obtained from Prudential Singapore/Prudential Financial Representative.

A potential investor should read the Product Summary, Fund Information Booklet and Product Highlights Sheet before deciding whether to subscribe for units in the ILP sub-fund and seek professional advice before making any investment decision. In the event that investor chooses not to seek advice, he/she should consider carefully whether the ILP sub-fund in question is suitable for him/her.

Please note that the distribution of dividends is at the discretion of the underlying fund's Board of Directors, Manager and/or Prudential Singapore, and is not guaranteed. The distribution of dividends may be effectively paid out of capital, which will reduce the net asset value of the fund which is used to calculate the fund’s unit price and the surrender value of the policy.

Whilst the Manager or Investment Manager has taken all reasonable care to ensure that the information contained in this document is not untrue or misleading at the time of publication, the Manager or Investment Manager cannot guarantee its accuracy or completeness. Any opinion or estimate contained in this document is subject to change without notice.

The information presented is for your information only and does not consider specific investment objectives, financial situation or needs of any person. It should not be relied upon as financial advice to buy, sell or hold any investment product or class of investment products.

Investments are subject to investments risks including the possible loss of the principal amount invested. The prediction, projection or forecast on the economy, securities markets or the economic trends of the markets targeted by the ILP sub-fund are not necessarily indicative of the future or likely performance of the Fund. The performance of the ILP sub-fund is not guaranteed and the value of the units and the income accruing to the units, if any may fall or rise.

Information is correct as at 14 November 2024.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.