Grow your retirement funds with SRS and enjoy

Single Premium Discount of up to 2.0%.

Single Premium Discount of up to 2.0%.

Retirement is more than just a phase of life — it’s a time to enjoy the fruits of your labour and live the life you’ve always dreamed of. By taking advantage of the Supplementary Retirement Scheme (SRS), you can grow your wealth while enjoying tax savings now and in the future.

Investing in a SRS-eligible insurance plan not only ensures a comfortable retirement but also provides the protection and peace of mind you deserve. With the right plan, you can take control of your financial future, build a strong retirement fund, and live confidently knowing you’re prepared for whatever comes next.

Benefits of adding SRS to your retirement deck

Enjoy tax reliefs

Every dollar you contribute to your SRS account is eligible for tax relief. Each year, Singaporeans and permanent residents may enjoy tax deduction of up to S$15,300, while foreigners may enjoy up to S$35,700, when contributing to SRS account.

Grow your funds with tax-free investment returns

SRS account is designed to help you prepare for your retirement through investments. By investing your SRS funds into various SRS-approved instruments, such as Fixed Deposits, Singapore Savings Bond (SSB), or Single Premium Insurance Saving Plans, you can earn better returns that may beat inflation.

Flexibility of withdrawal and tax concession

You can make penalty-free withdrawals from your SRS account from the age of 63, with the flexibility to spread out your withdrawals over a period of up to 10 years.

Gain tax concession during your retirement years as only 50% of the withdrawals are taxable after retirement age and by spreading out your withdrawals over the 10 years, you could potentially pay zero tax. This can be particularly advantageous for managing your tax liabilities in retirement.

Supercharge your savings with SRS-Eligible Insurance Plans

Did you know SRS cash funds only earn 0.05% p.a. return?

Yet as much as S$3.17 billion of SRS funds are lying in ideal cash. Make your money work for you in more ways than one, boost your savings growth, protect your savings and provide coverage for the future.

Choose from our range of SRS-eligible insurance plan, such as PRUActive Saver III, PRUActive Retirement II, and PRUWealth Plus (SGD), to grow and protect your SRS savings.

have retirement aces up your sleeve

Play your bonus card with our Glow with Confidence Promotion

Promotion from now till 31 December 2024

Insurance Savings (Supplementary Retirement Scheme - SRS)

Grow your retirement funds and enjoy single premium discounts of up to 2.0%.

Build your golden nest egg with Supplementary Retirement Scheme (SRS)

Learn more

Optimise your Supplementary Retirement Scheme (SRS) withdrawals

Learn moreTerms and Conditions for Supplementary Retirement Scheme (SRS) Insurance Savings in Glow with Confidence Promotion (“Promotion”)

- Promotion Details

-

Definitions:

- “Prudential” means Prudential Assurance Company Singapore (Pte) Limited.

- “Promotion Period” means the period between 1 October and 31 December 2024 (both dates inclusive).

- “Eligible Customer” means policyholder whose proposal for any Eligible Single Premium Insurance Plan is submitted to and incepted by Prudential during the Promotion Period having satisfied the eligibility criteria below.

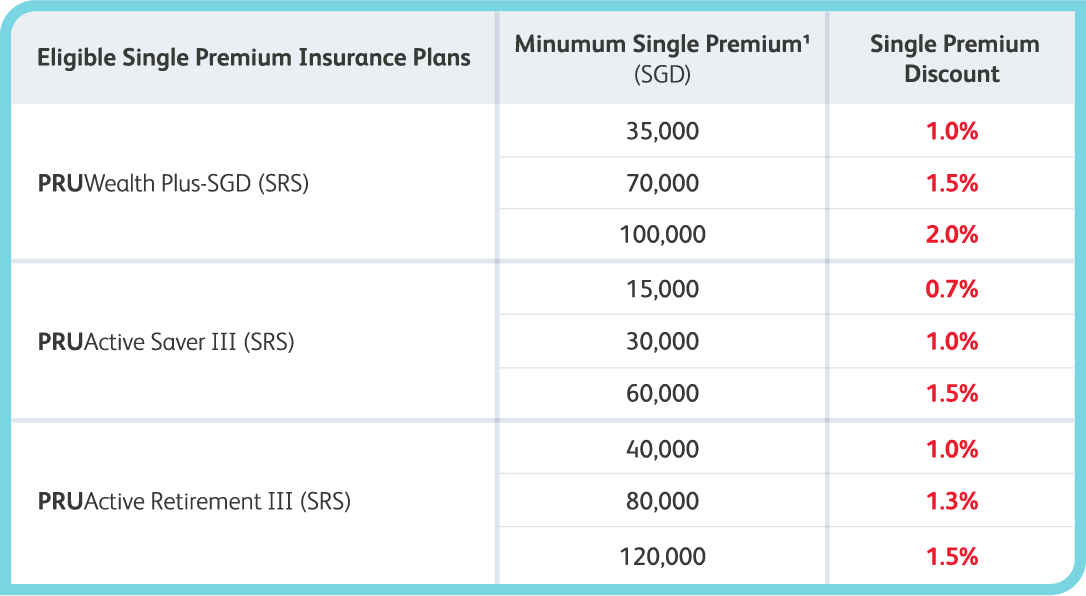

- “Eligible Single Premium Insurance Plan” means any of the products meeting the criteria as stated in the Promotion Table below.

- “Discount” means the single premium discount which is the percentage discount given to the Eligible Customer as stated in the Promotion Table below.

- “Promotion Table” means Promotion Table below.

Promotion Table

Eligible Single Premium Insurance Plans Minimum Single

Premium1 (SGD)Single Premium

Discount2Insurance Savings - Supplementary Retirement Scheme (SRS) PRUWealth Plus (SGD) - SRS 35,000 1.0% 70,000 1.5% 100,000 2.0% PRUActive Saver III (SRS) 15,000 0.7% 30,000 1.0% 60,000 1.5% PRUActive Retirement II (SRS) 40,000 1.0% 80,000 1.3% 120,000 1.5%

Footnotes

1 The Minimum Single Premium is defined as a single up-front premium payment to fully pay for the basic policy

2 Discount is applicable on total single premium paid for the basic policy.

-

Eligibility

To be eligible for the Promotion, the Eligible Customer has to satisfy the following requirements in order to receive the Discount as defined in the Promotion Table:

- The Eligible Customer’s proposal for an Eligible Single Premium Insurance Plan is submitted to and incepted by Prudential during the Promotion Period.

- This Promotion is valid for single premium mode only.

- If the Eligible Customer's proposal for any Eligible Single Premium Insurance Plan fulfils the criteria of other promotions carried out by Prudential, the promotion with the higher value will be granted to the Eligible Customer.

-

Discount

- An Eligible Customer is entitled to receive the Discount in accordance with Promotion Table above.

- The Discount in this Promotion shall be on a ‘per-policy’ basis subject to the Terms and Conditions of this Promotion.

- The Discount in this Promotion is not applicable should the Eligible Single Premium Insurance Plans be cancelled within the fourteen (14) day free-look period. The premium amount refunded will be based on the premium amount paid by the Eligible Customer.

- The Discount is not applicable should the Eligible Single Premium Insurance Plan be Not Taken Up and subsequently reopened, or the Eligible Single Premium Insurance Plan has lapsed and subsequently reinstated.

- The Discount will be applied automatically at policy issuance upon meeting the eligibility criteria.

- By participating in the Promotion, each Eligible Customer is deemed to have accepted and agreed to be bound by these Terms and Conditions contained herein and any other instructions, terms and conditions that Prudential may issue from time to time.

- Prudential assumes no responsibility for incomplete, lost, late, damaged, illegible or misdirected forms or email communication, for technical hardware or software failures of any kind, lost or unavailable network connections, or failed incomplete, garbled or delayed electronic transmission which may limit an Eligible Customer’s ability to participate in the Promotion.

- Prudential has the sole and absolute discretion to exclude any Eligible Customer from participating in the Promotion without any obligation to furnish notice and/or reason.

- Prudential reserves the right to disqualify or disregard any Eligible Customer who does not comply with the Terms and Conditions.

- Prudential may at its discretion forfeit the Discount, or, if already awarded, reclaim the Discount at the expense of the Eligible Customer without payment, compensation, or having to give any reason whatsoever in the event Prudential subsequently discovers that the Eligible Customer is not eligible to participate in the Promotion and/or to receive the Discount.

- Prudential reserves the right to replace any Discount with items of similar value at any time without prior notice.

- Prudential reserves the right to request for the Eligible Customers’ proof of eligibility, identity and/or otherwise for the purposes of verifying the Eligible Customer’s claim to the Discount at the time of Discount allocation. Prudential is under no obligation whatsoever to disclose the identity of the Eligible Customers or to publish the same for any reason at any point of time.

- The Discount is not exchangeable for cash, credit or any other items of equivalent value. The validity period of the Discount is non-extendable. Prudential will be under no obligation to replace or pay to Eligible Customers the value of any Discount that that are not utilised by the Eligible Customers before the end of the validity period of the Discount as may be stipulated by Prudential.

- The Promotion is not valid in conjunction with other promotions carried out by Prudential.

- By participating in this Promotion, each Eligible Customer agrees and consents under the Personal Data Protection Act (Cap 26 of 2012) to the collection, use and disclosure of any and all personal data of the Eligible Customer by/to Prudential, advertising and promotional agencies of the Promotion and such other third party, in Prudential’s absolute discretion, consider appropriate or necessary in connection with the Promotion and redemption of Discount.

- If an Eligible Customer provides Prudential with personal data of any third party, that Eligible Customer hereby:

- Agrees on behalf of that third party to be bound by the Terms and Conditions contained herein; and

- Consents on behalf of that third party, to Prudential’s collection, use, disclosure and processing of his/her personal data in accordance with the Terms and Conditions contained herein.

- Prudential shall not be liable for any third party’s misuse of the Eligible Customer’s submitted information and photograph as a result of the Eligible Customer taking part in the Promotion.

- Unless prohibited by law, participation in the Promotion constitutes permission for Prudential, its advertising and promotional agencies to use any of the Eligible Customer’s names, and/or likeness for advertising and promotional purposes. Each Eligible Customer further agrees and acknowledges that the copyright and all other intellectual property rights in and to all photographs or audio-video or other recordings of the Eligible Customer taken or made in connection with the Promotion shall vest solely and absolutely in Prudential without any compensation to the Eligible Customer.

- Prudential may at any time at its absolute discretion, without prior notice or assigning any reason thereof or being liable to any person, (i) suspend, cancel or terminate the Promotion, or (ii) delete, vary, supplement, amend, modify any one or more of the terms and conditions of the Promotion. Prudential’s determination of all matters in connection with the Promotion and the Discount shall be final, binding and conclusive. Prudential is not obliged to give any reason or prior notice on any matter concerning the Promotion or the Discount. No appeal, correspondence or claims will be entertained. Prudential has the right and discretion to determine whether a party has met the requirements of the Promotion and/or to receive the Discount. Eligible Customers shall not be entitled to any damages or compensation whatsoever or howsoever arising as a result of such amendment, suspension or termination.

- By participating in the Promotion, all Eligible Customers agree and undertake to, at all times, indemnify, keep indemnified, and hold Prudential, its employees and agents harmless against all losses (including direct, indirect, incidental and/or consequential losses), damages (including general, special, and/or punitive damages), demands, injuries (other than personal injury caused by Prudential’s negligence), claims, costs, penalties, interest and fees (including all legal fees as between solicitor and client or otherwise on a full indemnity basis whether or not incurred in respect of any real, anticipated, or threatened legal proceedings), howsoever caused by, arising or resulting from, whether directly or indirectly, their participation in the Promotion, acceptance or usage of any Discount, and/or any breach or purported breach of these terms and conditions and/or any applicable law.

- In the event of any inconsistency or discrepancy between the Terms and Conditions and the contents of any brochure, marketing and/or promotional materials relating to the Promotion, these Terms and Conditions shall prevail.

- Any trademarks, graphic symbols, logos or intellectual property contained in any materials used in connection with this Promotion, in particular the Discount, are the property of their respective owners. Prudential is not affiliated with, or endorsed or sponsored by, such owners and their relevant affiliates.

- Failure by Prudential to exercise any of its right or remedy under these Terms and Conditions does not constitute a waiver of that right or remedy.

- The Terms and Conditions shall be governed by Singapore law and the Eligible Customers agree to submit to the exclusive jurisdiction of the courts of Singapore.

- A person who is not a party to any agreement governed by these terms and conditions shall have no right under the Contracts (Right of Third Parties) Act (Cap 53B) to enforce any of these terms and conditions.

B. General Terms and Conditions

Important Notes

You are recommended to read the product summary and seek advice from a qualified Prudential Financial Representative for a financial analysis before purchasing an insurance policy suitable to meet your needs.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

The information contained herein is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details, and exclusions applicable to these insurance products in the policy documents that can be obtained from your Prudential Financial Representative.

The information contained herein is for distribution in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

The information presented cannot be reproduced, amended or circulated in whole or in part to any other person without our prior written consent.

Information is correct as of 5 November 2024.

This advertisement has not been reviewed by the Monetary Authority of Singapore.