Protecting Your Family’s Tomorrow

Where do your priorities lie? Consider you and your family’s needs and what you will require to safeguard the present and future.

Protection

Beyond your basic coverage, additional coverage ensures comprehensive care, creating a reliable safety net for you and your loved ones. This way, you can rest easy knowing they are well-protected against unexpected medical costs.

What you already have1

If you are a Singaporean or PR, you’re automatically covered by three national schemes:

-

MediSave

A national savings scheme which helps CPF members save for future medical expenses, especially during retirement. -

MediShield Life

A health insurance for large hospital bills and selected outpatient treatment costs. -

CareShield Life

Long-term care insurance scheme for financial support and monthly cash payouts in event of severe disability.

What you may consider2,4

Are you fully prepared for life's surprises with your current protection policies? It's crucial to ensure you have enough coverage to avoid a protection gap – when your savings, investments, and insurance fall short of covering unexpected expenses due to health issues.

Here's how to find out your protection gap3:

- Calculate Needs: Multiply your annual income by nine (for death) or four (for critical illness)2. This is what your family will need to manage without your income.

- Assess Resources: Add up your savings, assets, and current coverage. These are the funds available to your family.

- Find The Gap: Subtract the needs from the resources.

If the result is negative, there's a protection gap. This means your family might struggle financially if something happens to you.

National schemes do not fully cover:

-

Hospitalisation

An Integrated Shield Plan (IP) provides additional coverage for private hospitals or higher ward classes in public hospitals. -

Critical Illness

You’ll need coverage of 4x annual income. (Recommended)4 -

Death & Total and Permanent Disability

You’ll need coverage of 9 – 10x annual income. (Recommended)4

It’s recommended to spend at most 15% of take-home pay on insurance protection.

Why Act Now

Misconceptions? Let’s correct them.

Check out some common misunderstandings about financial planning and their truths.

Misconception: It’s okay not to disclose your existing medical condition.

Truth:

It's best to be open about your pre-existing medical conditions. Hiding them could result in claim rejections or even a terminated plan if discovered. Having pre-existing conditions doesn’t mean you can’t get insured in Singapore; it just means there might be some extra considerations for coverage and premiums.

Yes, I want an expert’s help

It's best to be open about your pre-existing medical conditions. Hiding them could result in claim rejections or even a terminated plan if discovered. Having pre-existing conditions doesn’t mean you can’t get insured in Singapore; it just means there might be some extra considerations for coverage and premiums.

Misconception: I am not eligible for insurance because I am too old or have a pre-existing condition.

Truth:

You can still purchase health and/or life insurance in Singapore, though some additional considerations will be factored in due to age or pre-existing conditions. There are specialised plans so it’s best to consult a Financial Representative to understand what’s best for your condition, age and financial goals!

Yes, I want an expert’s help

You can still purchase health and/or life insurance in Singapore, though some additional considerations will be factored in due to age or pre-existing conditions. There are specialised plans so it’s best to consult a Financial Representative to understand what’s best for your condition, age and financial goals!

Misconception: Having health insurance means all treatments are fully covered.

Truth:

Not always. Policies can have limits, gaps, and exclusions. It's a good idea to review your coverage, spot any gaps, and consider extra insurance or add-ons based on your health and family history to avoid unexpected medical bills.

Yes, I want an expert’s help

Not always. Policies can have limits, gaps, and exclusions. It's a good idea to review your coverage, spot any gaps, and consider extra insurance or add-ons based on your health and family history to avoid unexpected medical bills.

Source: Health insurance terms: Know what you’re paying for, Moneysense

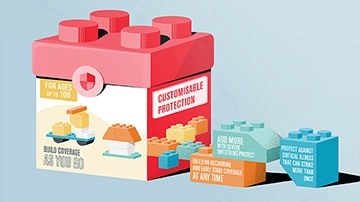

Find The Right Plan

Be protected against unforeseen medical expenses, rising healthcare costs or unexpected injuries with our suite of tailored products and supplementary plans.

Get ultimate peace of mind for you and your family by protecting against potential financial impacts during unfortunate diagnoses of critical illnesses such as cancer.

Get comprehensive essential coverage no matter the life stage you’re at.