Prime A Better Future For Your Growing Family

Prioritise securing a safer and better tomorrow for you and your loved ones.

Protection

Creating a proper safety net is critical for you and your young children. It will give you peace of mind knowing that everyone is cared for should any unfortunate events happen.

What you already have1

If you are a Singaporean or PR, you’re automatically covered by three national schemes:

-

MediSave

A national savings scheme which helps CPF members save for future medical expenses, especially during retirement. -

MediShield Life

A health insurance for large hospital bills and selected outpatient treatment costs. -

CareShield Life

Long-term care insurance scheme for financial support and monthly cash payouts in event of severe disability.

What you may consider2

Are you fully prepared for life's surprises with your current protection policies? It's crucial to ensure you have enough coverage to avoid a protection gap – when your savings, investments, and insurance fall short of covering unexpected expenses due to health issues.

Here's how to find out your protection gap3:

- Calculate Needs: Multiply your annual income by 9 (for death) or 4 (for critical illness)2. This is what your family will need to manage without your income.

- Assess Resources: Add up your savings, assets, and current coverage. These are the funds available to your family.

- Find The Gap: Subtract the needs from the resources.

If the result is negative, there's a protection gap. This means your family might struggle financially if something happens to you.

National schemes do not fully cover:

-

Hospitalisation

An Integrated Shield Plan (IP) provides additional coverage for private hospitals or higher ward classes in public hospitals. -

Critical Illness

You’ll need coverage of 4x annual income. (Recommended)4 -

Death & Total and Permanent Disability

You’ll need coverage of 9 – 10x annual income. (Recommended)4 -

Maternity

Coverage for baby and mum.

It’s recommended to spend at most 15% of take-home pay on insurance protection.

Why Act Now

Misconceptions? Let’s correct them.

Check out some common misunderstandings about financial planning and their truths.

Misconception: My life insurance coverage only needs to be twice my annual salary.

Truth:

In general, it’s recommended to have 9-10X your annual earnings as basic life coverage. However, this amount can vary depending on your family expenses and desired legacy, so it’s best to consult with a Financial Representative who can give you a plan that fits your needs.

Yes, I want an expert’s help

In general, it’s recommended to have 9-10X your annual earnings as basic life coverage. However, this amount can vary depending on your family expenses and desired legacy, so it’s best to consult with a Financial Representative who can give you a plan that fits your needs.

Source: 2022 protection gap study – Singapore, Life Insurance Association Singapore, 8 September 2023

Misconception: I am young and healthy, I don’t need insurance.

Truth:

While this is true, it is also true that health issues can arise at any time, regardless of age. It’s also wise to lock in a lower premium at a younger age.*

Yes, I want an expert’s help

While this is true, it is also true that health issues can arise at any time, regardless of age. It’s also wise to lock in a lower premium at a younger age.*

Misconception: Health insurance is only for old people.

Truth:

Health issues and accidents can happen to anyone at any age. While older people might be more prone to certain illnesses, it's important for everyone to have health insurance. If you wait until you're older, insurers might exclude pre-existing conditions. Protect yourself by getting coverage early on.

Yes, I want an expert’s help

Health issues and accidents can happen to anyone at any age. While older people might be more prone to certain illnesses, it's important for everyone to have health insurance. If you wait until you're older, insurers might exclude pre-existing conditions. Protect yourself by getting coverage early on.

Source: Understanding Health Insurance, Moneysense

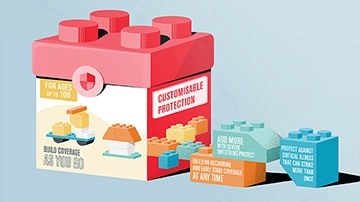

Find The Right Plan

Be protected against unforeseen medical expenses, rising healthcare costs or unexpected injuries with our suite of tailored products and supplementary plans.

Get ultimate peace of mind for you and your family by protecting against potential financial impacts during unfortunate diagnoses of critical illnesses such as cancer.

Get comprehensive essential coverage no matter the life stage you’re at.